for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreUsing a 401(k) loan, your clients can cover the costs of an emergency or unplanned expense. For many clients, their 401(k) is their largest financial asset. They can access 50% of their assets or $50,000 (whichever is less) tax-free with a 401(k) loan.

Interest on 401(k) loans are repaid to their own account allowing them to borrow without a loss.

So how do you model an existing loan in eMoney using Advanced Planning?

Start by answering two important questions:

If the connection is bringing over the Gross Amount…

Create a plan and Add a New > Liability > Loan for the loan amount with the necessary loan terms. This will create the necessary outflow to model the repayment of the loan.

If the connection is bringing over the net amount…

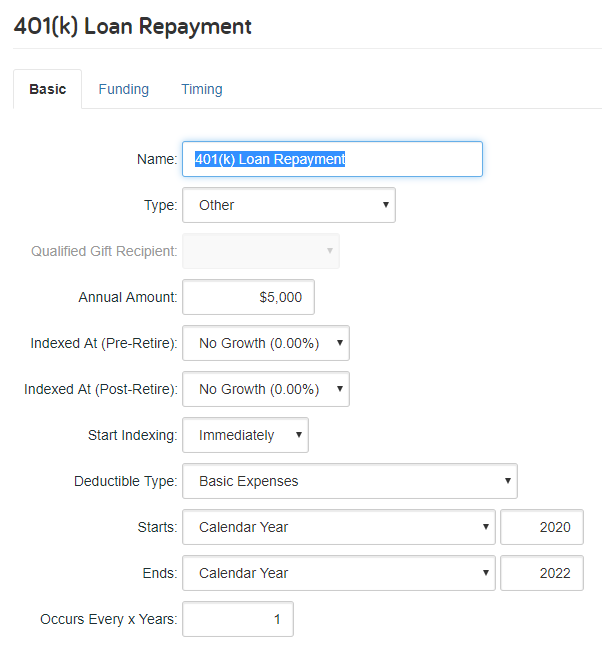

If the connection is bringing over the net value, a loan will double count the liability. In this case, we want to create an Other Expense. Then set the Annual Amount as the amount being paid back each year, set the Deductible Type to Basic Expenses and set the Start Date and End Date based on the terms of the loan.

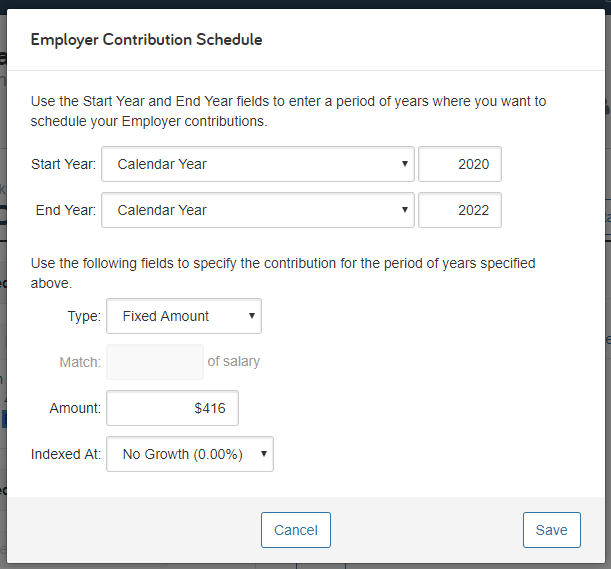

Finally, increase the Employer Contributions on the account by the expense amount. With this approach, our repayment is the expense. It’s entered as a liability to avoid double counting against the client’s balance sheet while the Employer Contribution adds the repayments to the 401(k) without giving us additional deductions.

To model a future 401(k) loan…

Use Advanced Planning Add a New technique to create a new Liability and define the loan terms. In this case, the Start Date is the year the client will take the loan.

Since we’re not modifying the 401(k) loan amount, we only need to model the inflow and the repayment of the loan. This technique uses the rate at which the 401(k) grows to account for interest and repayments. If necessary you can lower the 401(k) accounts rate of return to account for the difference between the interest rate and the growth rate.

Questions? Give us a call at 888-362-8482 or send us an email.