for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreA What-if is a planning tool used to illustrate an uncontrollable life or market event that could negatively impact your client’s financial plan. What-ifs are a way to stress-test your client’s base case or recommended scenario.

Today, we’ll focus on how to incorporate What-ifs in a client’s financial plan to help prepare them for life’s unexpected events such as premature death or a bear market.

To access all your available planning tools, you’ll navigate to the Plans tab of a client’s overview page. Here, you’ll scroll to Additional Tools to find your What-ifs.

eMoney provides a default list of options for common events. You can add from this list or choose the blank option to create a more customized version.

Pro-tip: To help you stay organized and create a more personalized client experience, re-name What-ifs so they are self-explanatory to you and the client when applied to reports or in presentations. We recommend including the client name, the event, and the year the event occurs. For example, instead of premature death, you can re-name to Frank passes in 2022.

First, we’ll look at the impact on a surviving spouse, specifically if there is a life insurance need if a premature death occurs.

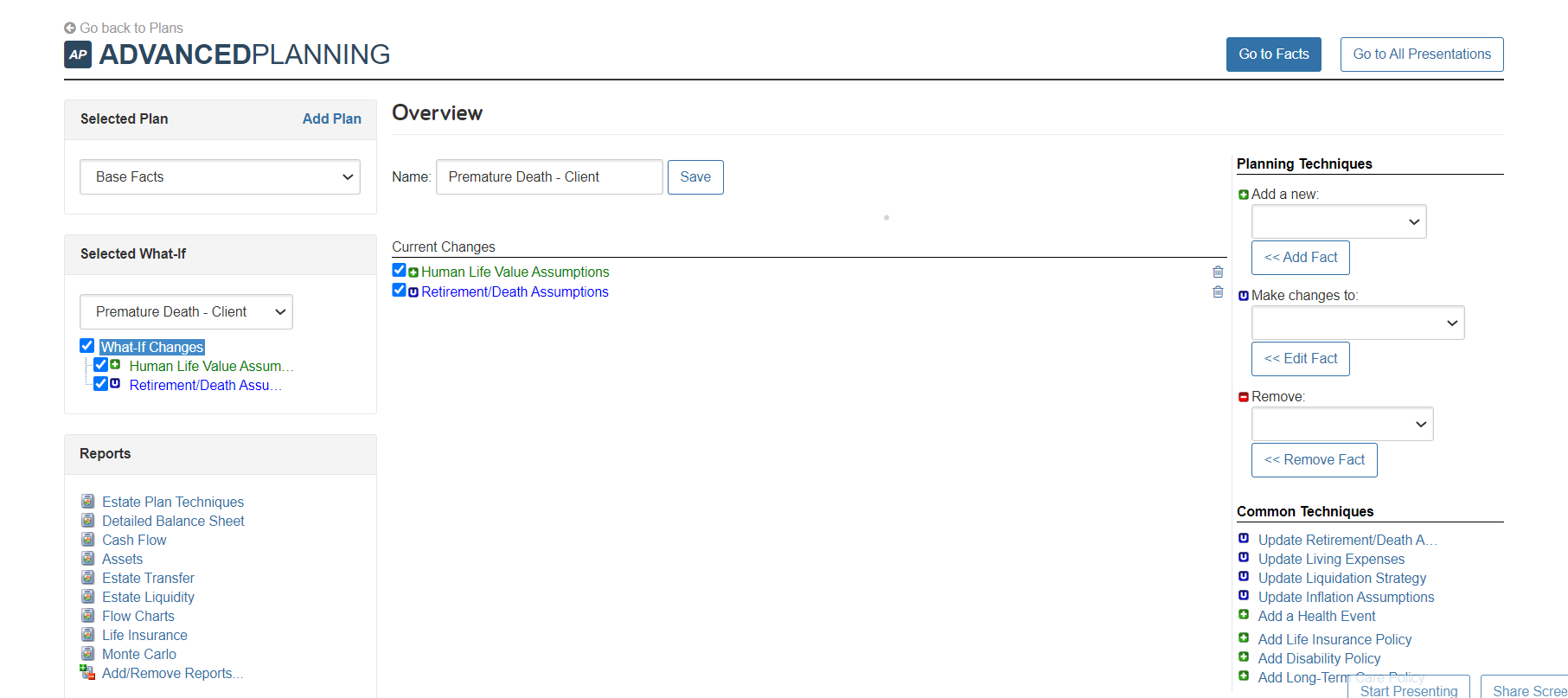

To set up the What-if, click Go next to Premature Death – Client. On the overview page, you’ll see two items automatically added. If you don’t use Human Life Value reports and use the gap analysis instead, click on the trashcan next to the Human Life Value Assumptions.

Next, you’ll simply click Retirement/Death Assumptions, change the assumed age of death to the current year or the year you’d like to test, and click Save.

Now you’re ready to use your reports to see how a premature death impacts a client’s plan. For quick access, you can view reports with the What-if already applied by clicking on the report names listed on the bottom left side of the overview page.

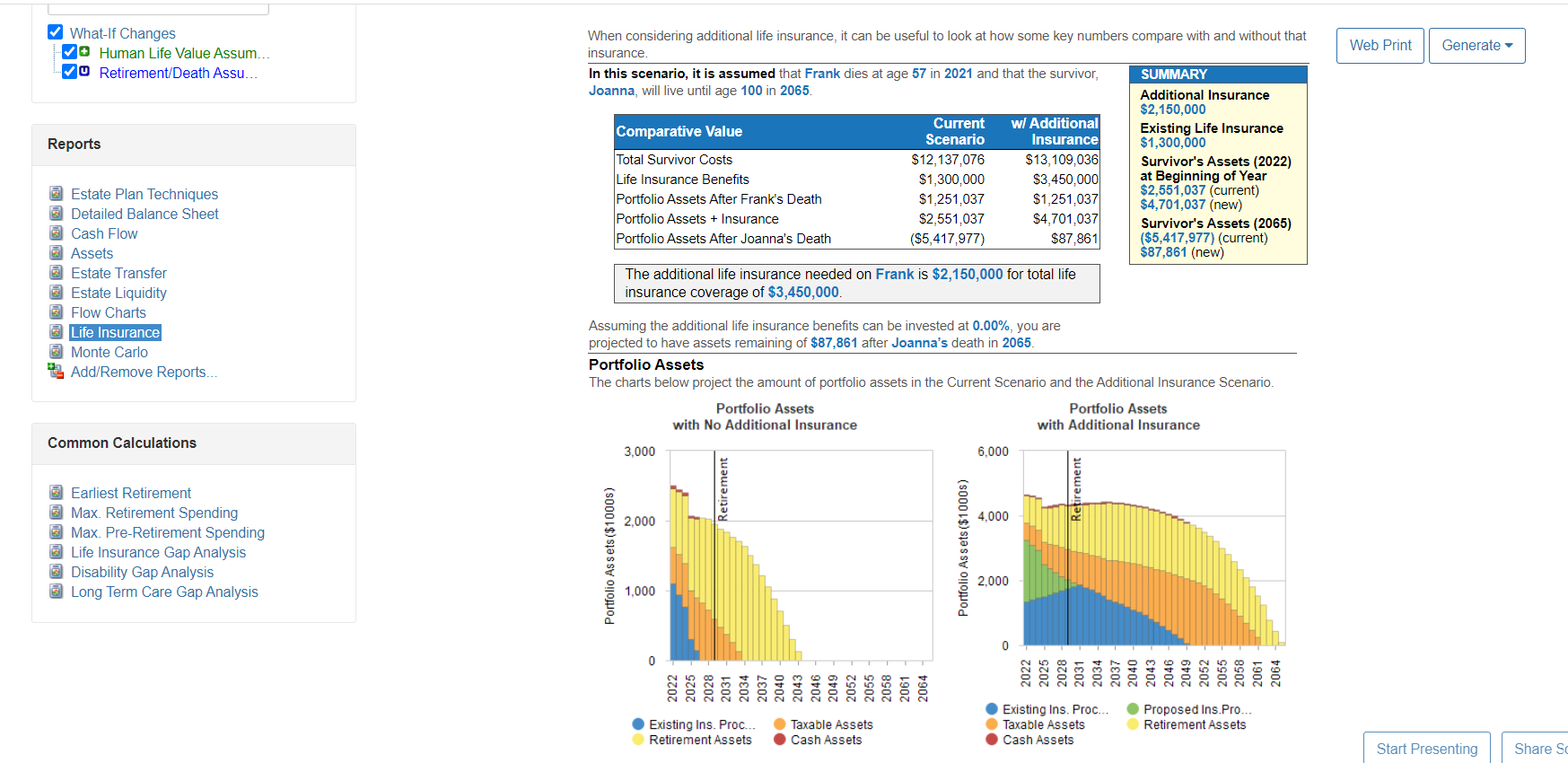

By selecting Life Insurance and viewing the Gap Analysis, you can easily show if your client needs additional life insurance should a premature death occur and the comparison between portfolio assets with and without additional insurance.

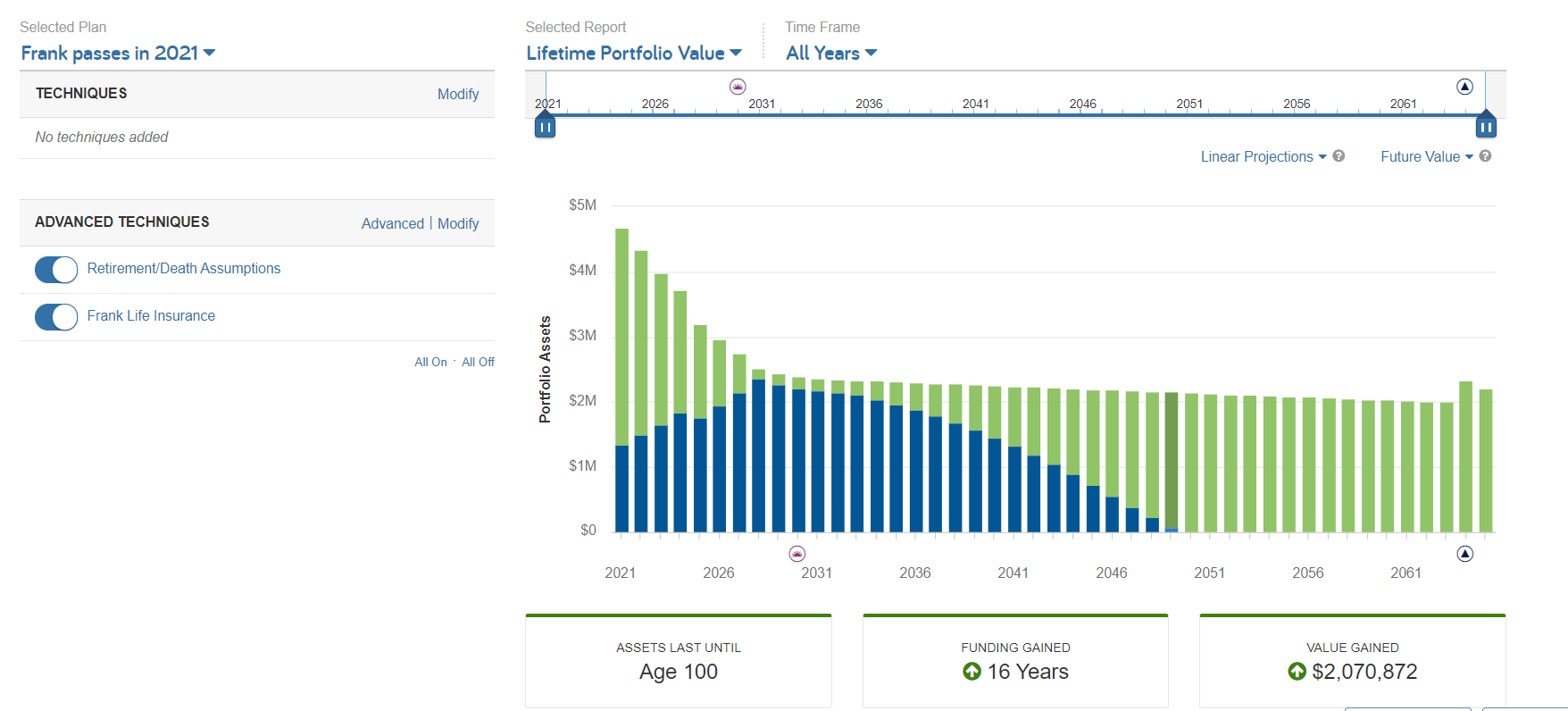

It’s important to note that What-ifs cannot be applied in the interactive planning tools. If you’d like to show your client the impact on their portfolio assets in a more visual way using Decision Center, you can recreate a What-if as a Scenario.

In your Plans section, you’ll add a new scenario. In this scenario, you’ll make changes to Assumptions > Retirement and Death and again, adjust the assumed age of death. You also can add your recommendation of additional insurance policies in the scenario. Once saved, you can now apply to Decision Center.

In Decision Center you can show the negative impact a premature death has on a client’s portfolio assets and then how your recommendations can help the surviving spouse’s assets last through their lifetime.

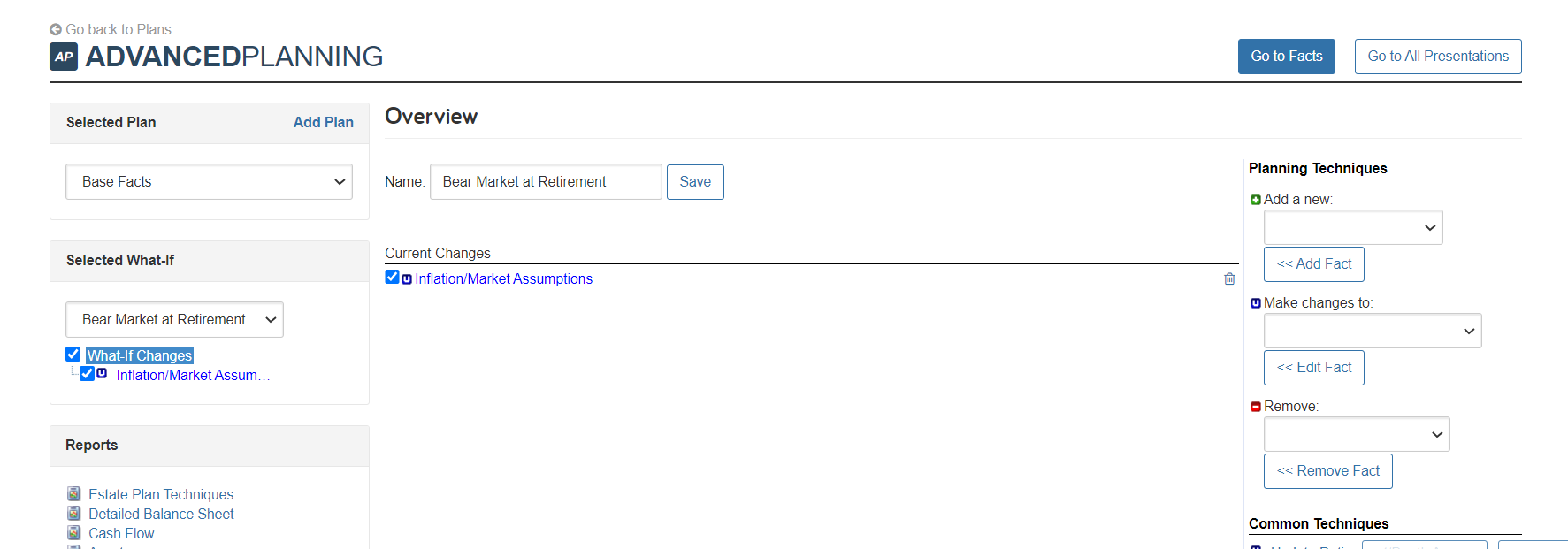

Now we’ll look at how to model a Bear Market at Retirement and what happens to a client’s portfolio if there’s a significant dip in the market for an extended period of time. You can find this event in the Add list under What-ifs. On the overview page, you’ll see one change automatically added – Inflation/Market Assumptions.

Next, you’ll click on the item and see you can change the inflation rate or account for an atypical market. Today we’re going to focus on the second option, an atypical market.

You’ll select when you want this market event to start and end, and you’ll adjust the portfolio rate of return. You can enter a negative percentage in this field.

Once saved, you can apply this unexpected market event to reports. For example, you can apply it to the Cash Flow report to see the impact on lifetime portfolio assets, or to Monte Carlo to see the impact on the probability of success.

Again, to view in Goal Planner or Decision Center, you’d recreate this What-if as a scenario and make the same changes to your Inflation/Market Assumptions.

To learn more about building What-ifs and how to incorporate them into a client’s plan, check out our webinar below.

For more information on the key differences between Scenarios and What-ifs and where to apply each, read Advanced Planning: Scenarios vs. What-Ifs.