for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreNote: The case represented here as sample client Katie and Tim Stevens is now available under the sample clients Alesandra and Luis Rodriguez.

Have you ever had a prospect who thinks they’re on track to meet their goals?

It might be time for them to meet Katie and Tim Stevens.

Katie and Tim are our eMoney sample clients. They’re a great example of a family trying to manage finances on their own, but in need of a little extra guidance.

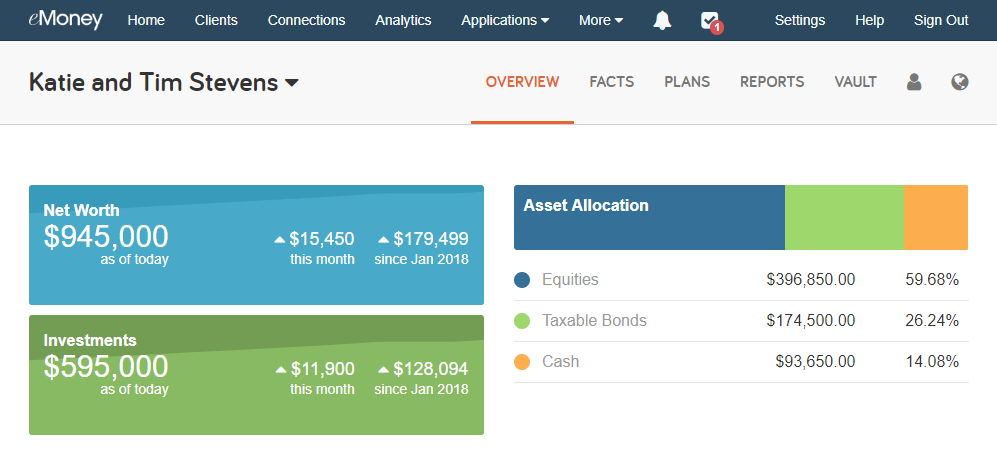

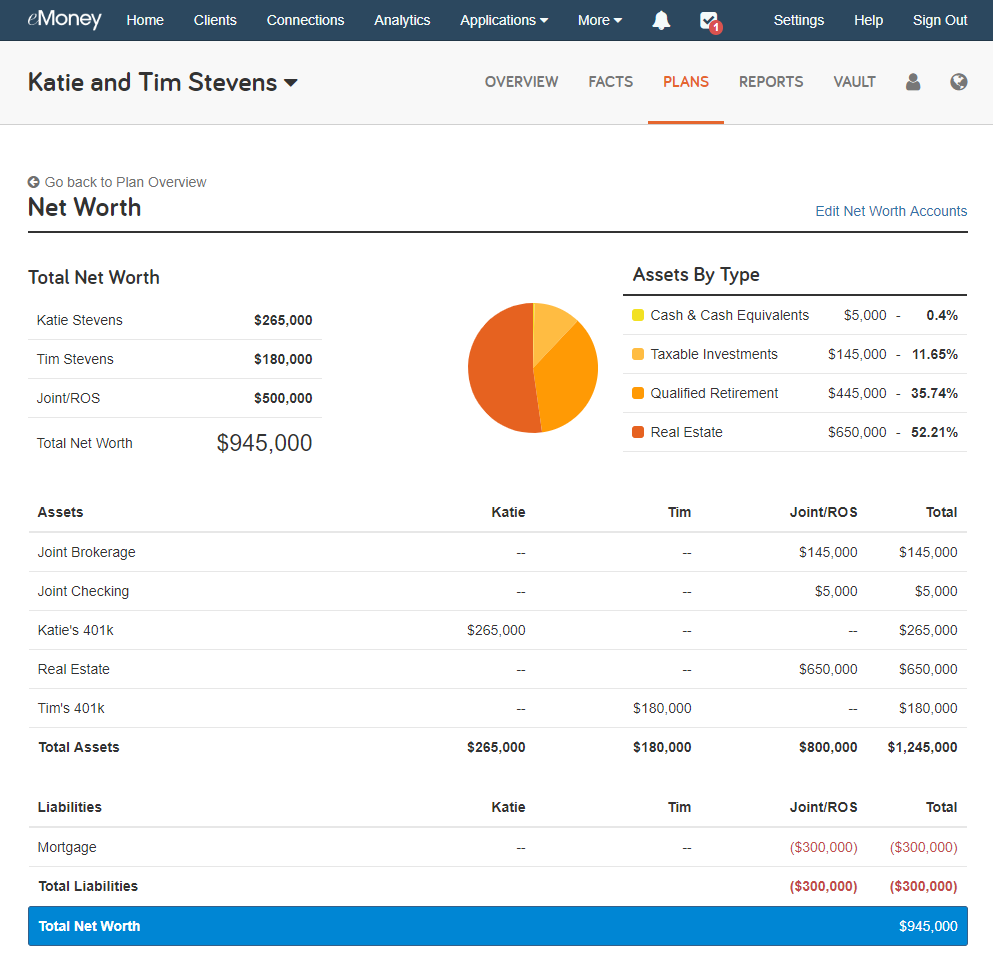

On the surface, they’re doing great. They’re in their early 30s and earn six-figure salaries. They’re contributing to their 401(k)s, and they’ve even opened 529 accounts for their two young children, Eva and Jack.

They have a net worth of over $900,000 and over 50 percent equity in their home. And no additional debt!

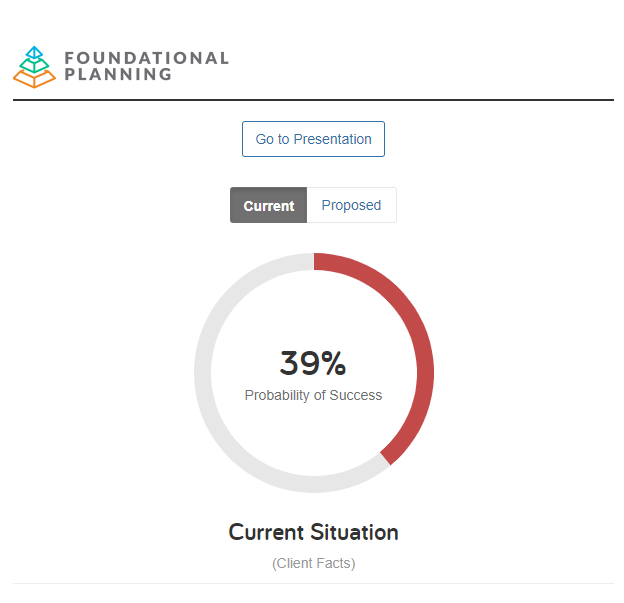

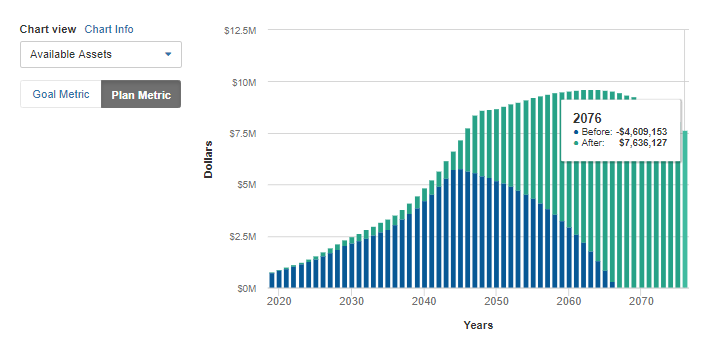

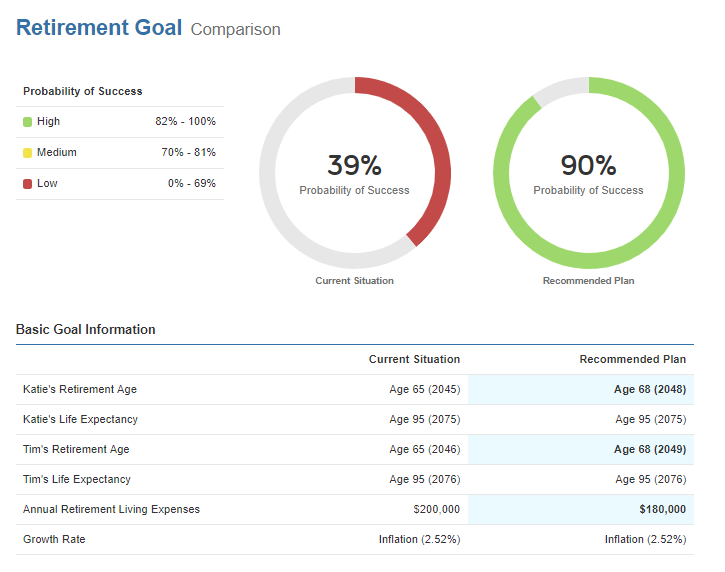

So it might surprise your prospects that they’re only projected a 36 percent probability of success to achieve their goals. A true financial plan needs to look at the entire financial picture.

So let’s take a closer look at the Stevens to see what important steps are missing from their self-guided financial plan.

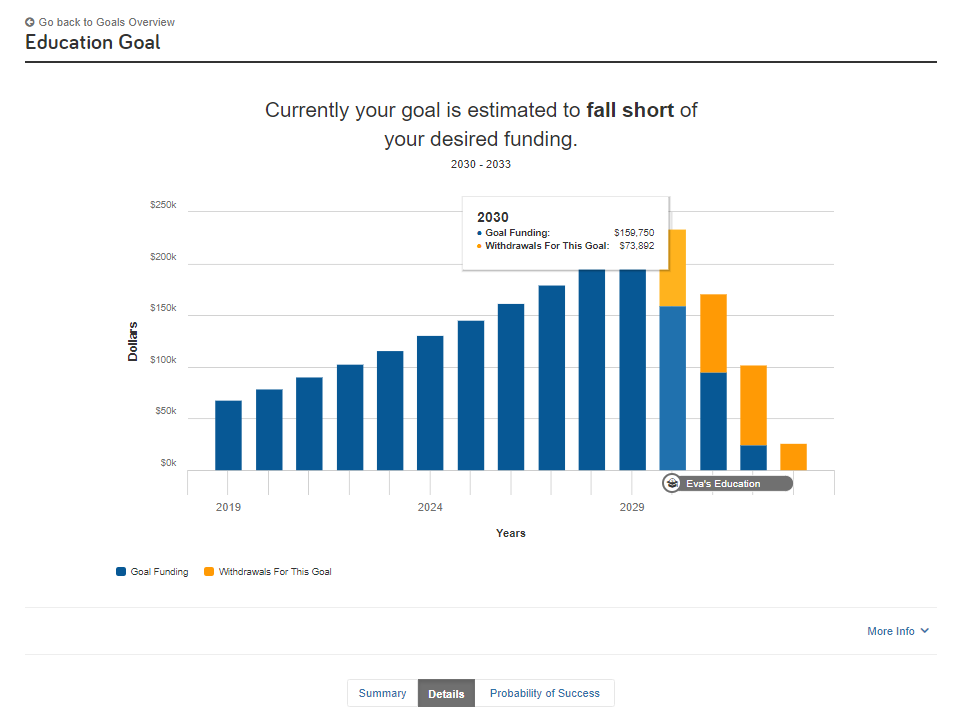

First, they’re not contributing enough to fully fund their children’s education goals. And that can impact important retirement assets later.

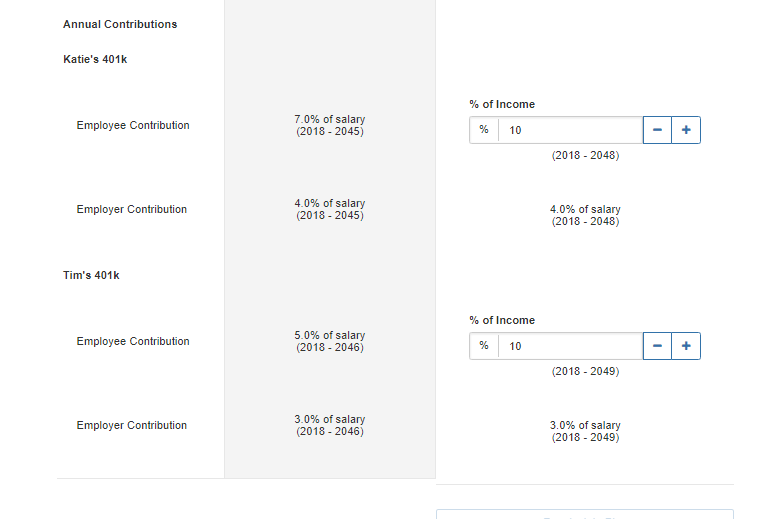

Next, if we look at their income, they should be contributing more to their 401(k)s, and leveraging the tax advantages of the accounts.

And finally, while they’re both strong earners, they’ve let their living expenses balloon with their salaries.

So how do you put them on track to achieve their goals? Foundational Planning is a great tool for these potential clients.

Let’s take a quick look at the “Recommended Plan” we built, which follows a few simple steps to set them on the right track.

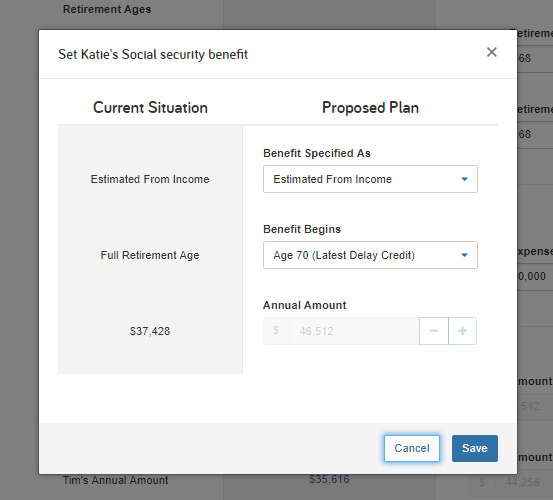

It starts by delaying retirement, and the start of their social security benefits.

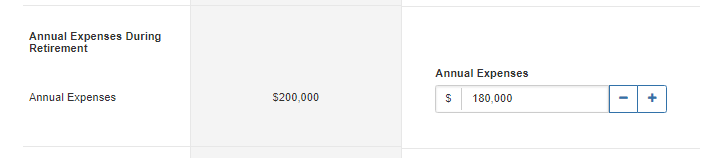

Then, we reduce their living expenses to a more sustainable level.

We also increase Katie and Tim’s 401(k) and 529 contributions to meet the demand of their funding goals.

Once we’ve taken everything into account, we jump from 36 percent to a healthy 87 percent probability of success.

It’s that easy to engage prospects and clients in planning-led relationships that can help them prepare for every life stage.

Stay tuned for more best practices on how to deliver more plans for more clients, more efficiently. Or click the link below to learn more about Foundational Planning.