for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe Ledger report can be great for fact-checking your cash flow simulation. You can check the accuracy of everything from contributions into qualified accounts, to the inflows and outflows of the core cash account, and even items that are taxable to your client. The Ledger report is best used alongside the Cash Flow or the Income Tax reports when fact-checking. So let’s take a look!

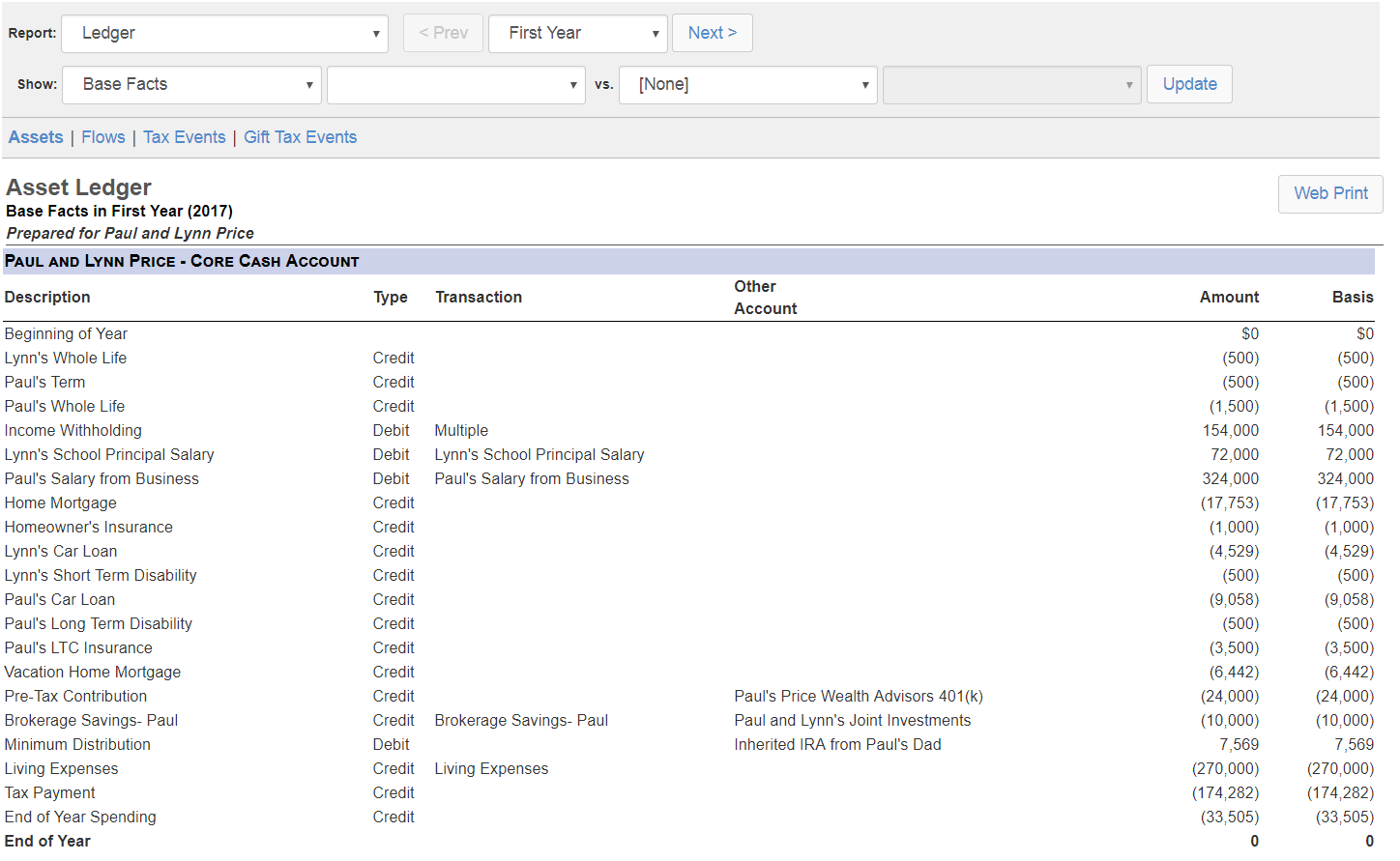

For this scenario, we’re looking at sample clients Paul and Lynn Price. Below is the Assets Ledger report and we can see the activity for the Core Cash Account. eMoney pays all expenses, insurance premiums, and liabilities directly from the Core Cash Account.

Looking at the income and expenses entered in the Advanced Facts, you can see if your annual income is sufficient to cover your yearly expenses or if you’re triggering the Liquidation Strategy to pay your expenses with funds from investable assets. This can cause additional expenses in the form of taxes or even liquidate retirement accounts prematurely.

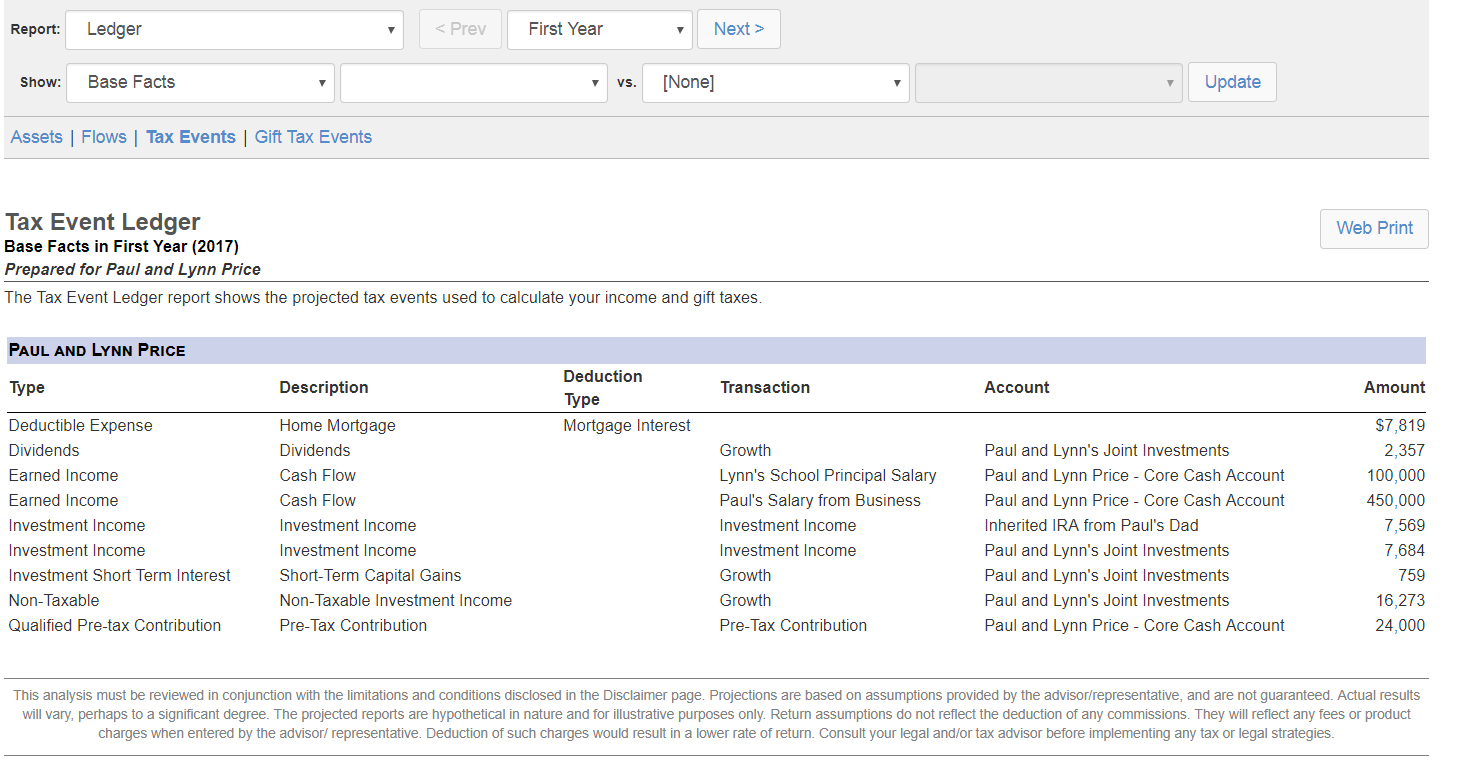

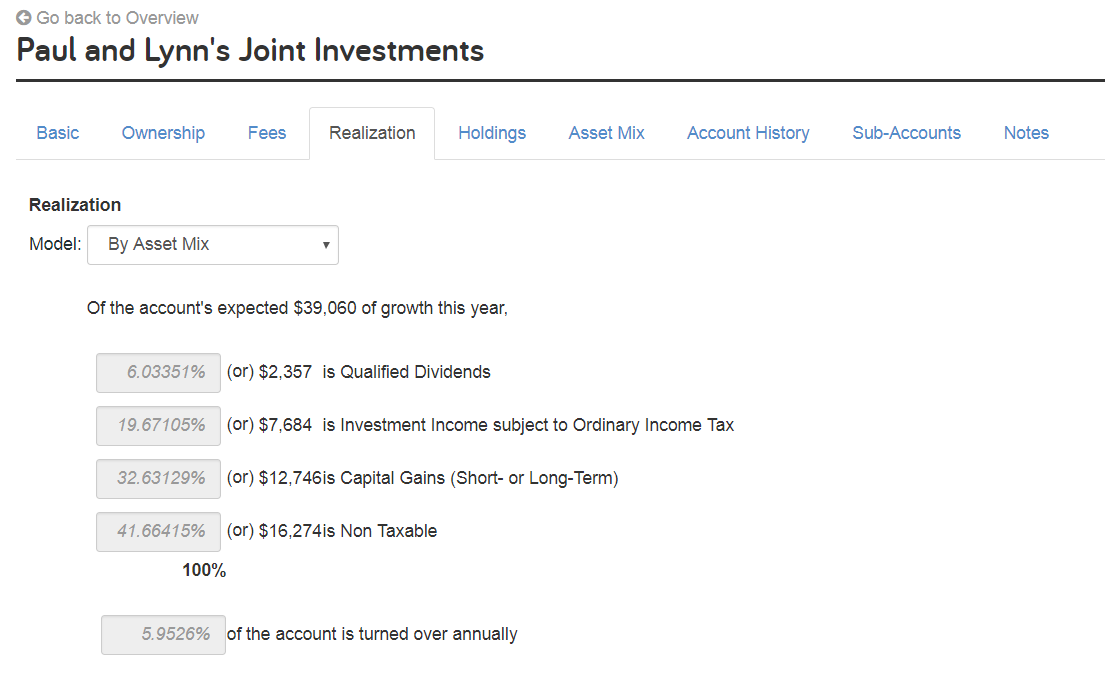

Another sub-report in the Ledger is Tax Events. The Tax events Ledger shows you what is taxable to the client. Using this report is excellent for checking the realization model for any taxable investments. You’ll see that the Tax Events ledger will mirror the Realization Model of your investments and help you identify issues where there is too much turnover or the Realization Model is set up incorrectly.

Looking at the Realization for this account we can see, as this is their only investment account, the Tax Events Ledger shows all of the dividends of $2,357, investment income of $7,684, and non-taxable of $16,274.