for expert insights on the most pressing topics financial professionals are facing today.

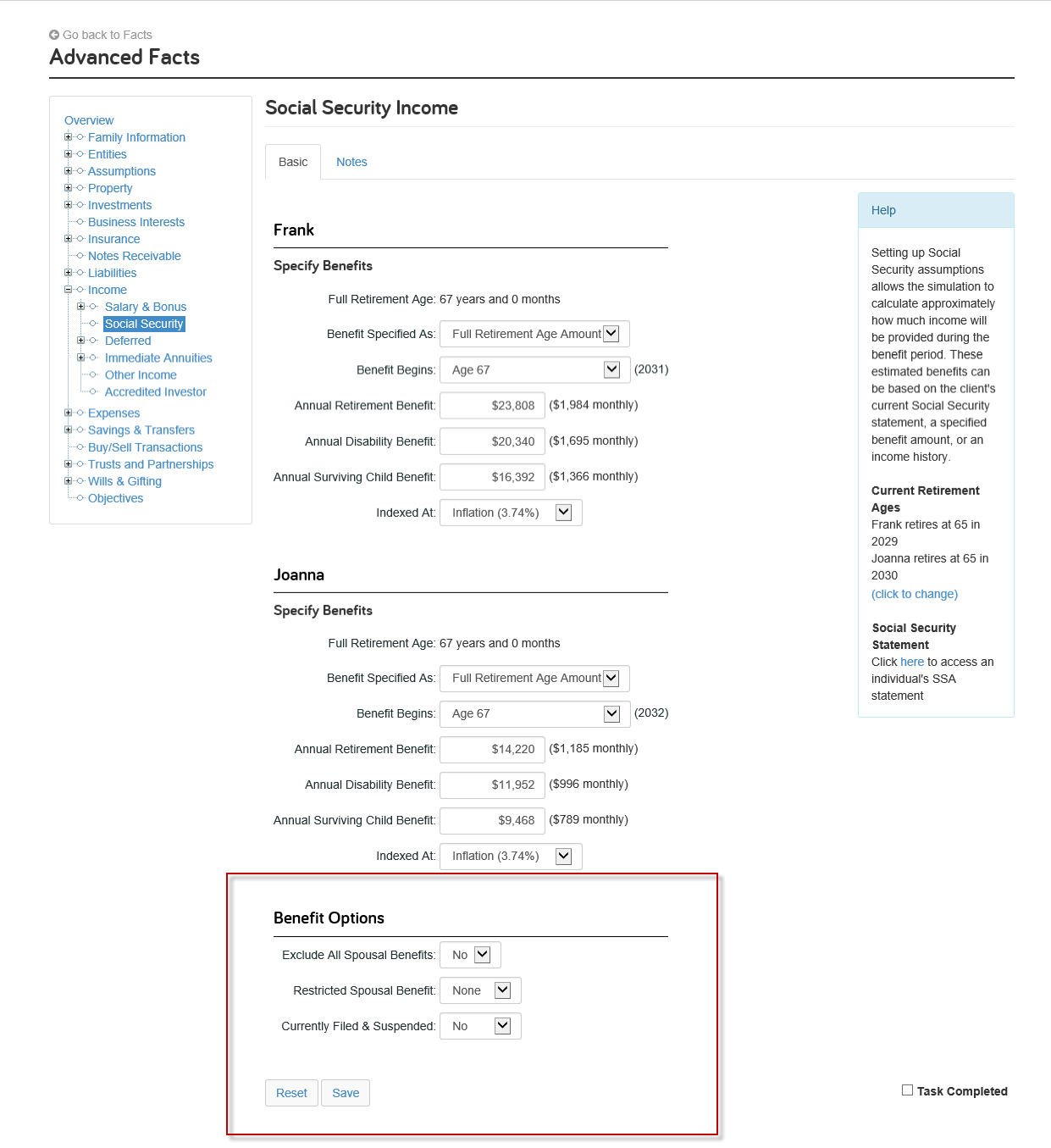

Learn MoreAs of April 30th, 2016 there was a bipartisan budget deal passed that eliminates two common social security strategies: file and suspend and the restricted spousal benefit. In reaction to this bill, compliance with the new Social Security Administration’s rules and regulations has been built into eMoney’s Fact Finder so that it will now disallow you to enter either of the restricted benefits if your client or spouse does not or did not ever qualify for either filing status. See the screenshot below for an example:

In our latest product update, we made the following changes to eMoney:

The new File and Suspend field is defaulted to “No” for all clients. This may cause a reduction in your social security projection compared to before this update. Advisors should check this field as needed and change the answer for those clients who have filed paperwork to file and suspend. We felt this was the most conservative approach to ensure social security projections were not inadvertently overly optimistic.

The eMoney planning team has created a FAQ for the common questions relating to these changes.

For more information regarding the new rules and regulations directly from the Social Security Administration, head over to the SSA website: https://www.ssa.gov/planners/retire/claiming.html