for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThis week’s tip focuses on the commonly used employee Profit Sharing Plan or 401(k) plan. Used in a majority of retirement plans, 401(k)s are a popular cost-efficient retirement investment vehicle, which is why it is important to understand how to add and plan for them in the eMoney system.

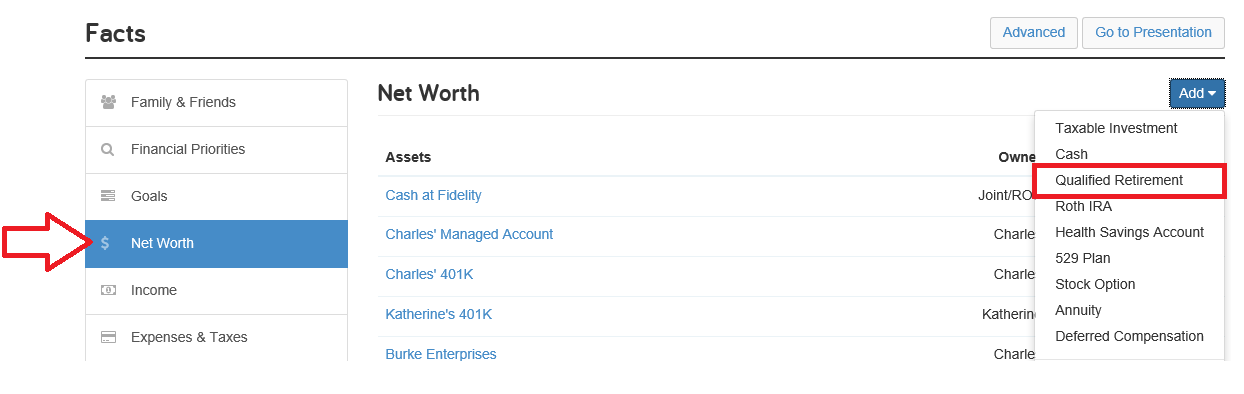

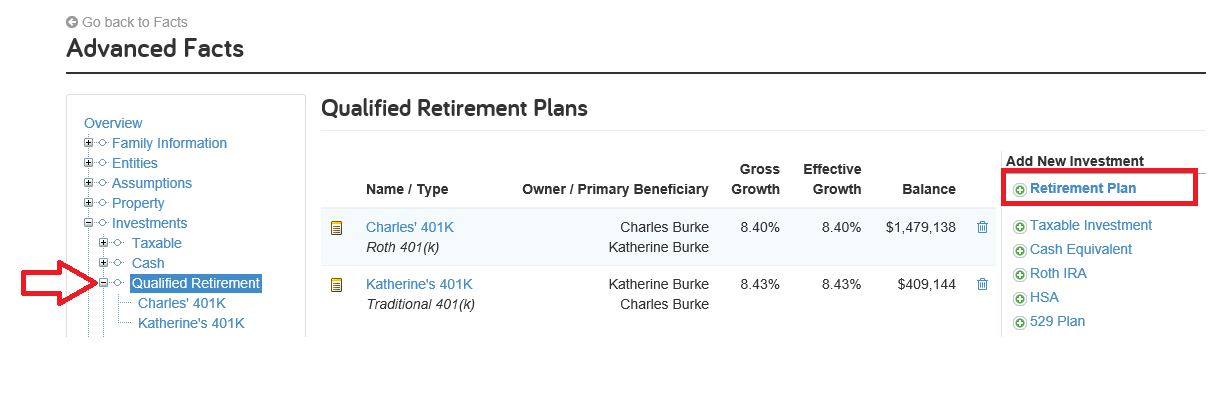

You can add a 401(k) plan by going to the Net Worth section in the basic fact finder, or by navigating to the advanced fact finder and clicking Investments, then Qualified Retirement, and then Add a New Retirement Plan.

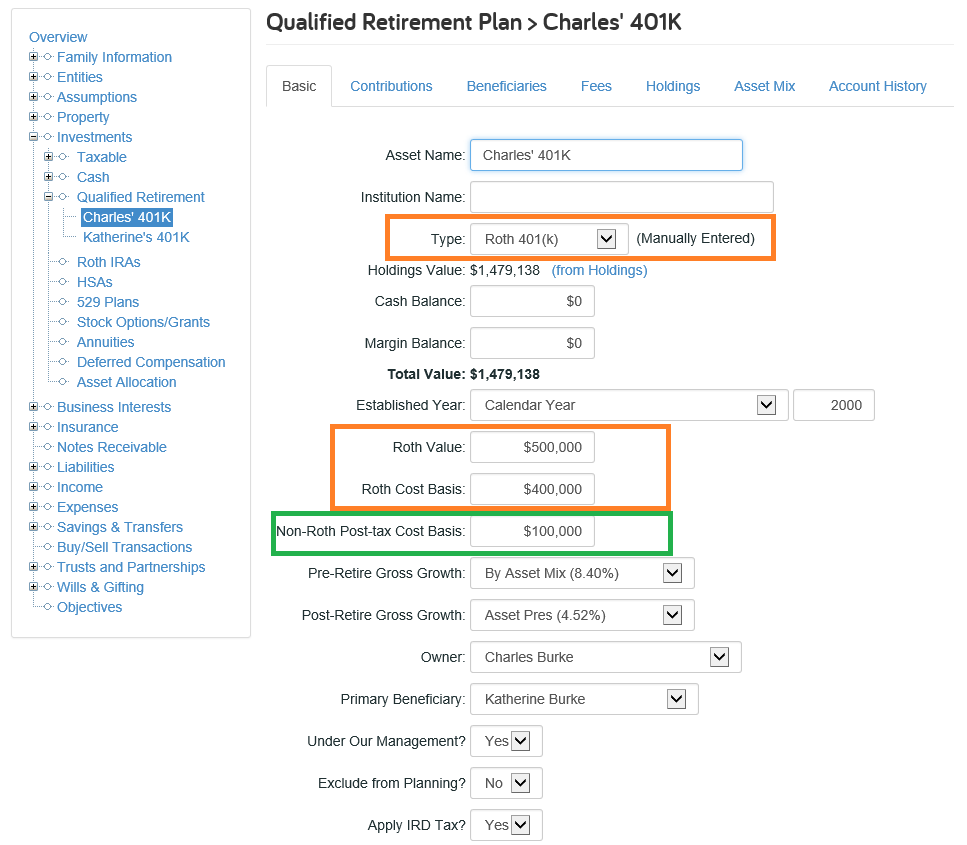

Typically, you can select the Traditional 401(k) account type, but if your client’s company offers a Roth portion in their profit sharing plan, then the appropriate account type is “Roth 401(k)”. When using the Roth 401(k) account type, you have the ability to manually enter the value and basis of the Roth portion. You can also enter in the Non-Roth Post-Tax cost basis to capture any non-deductible, non-Roth contributions made in the past.

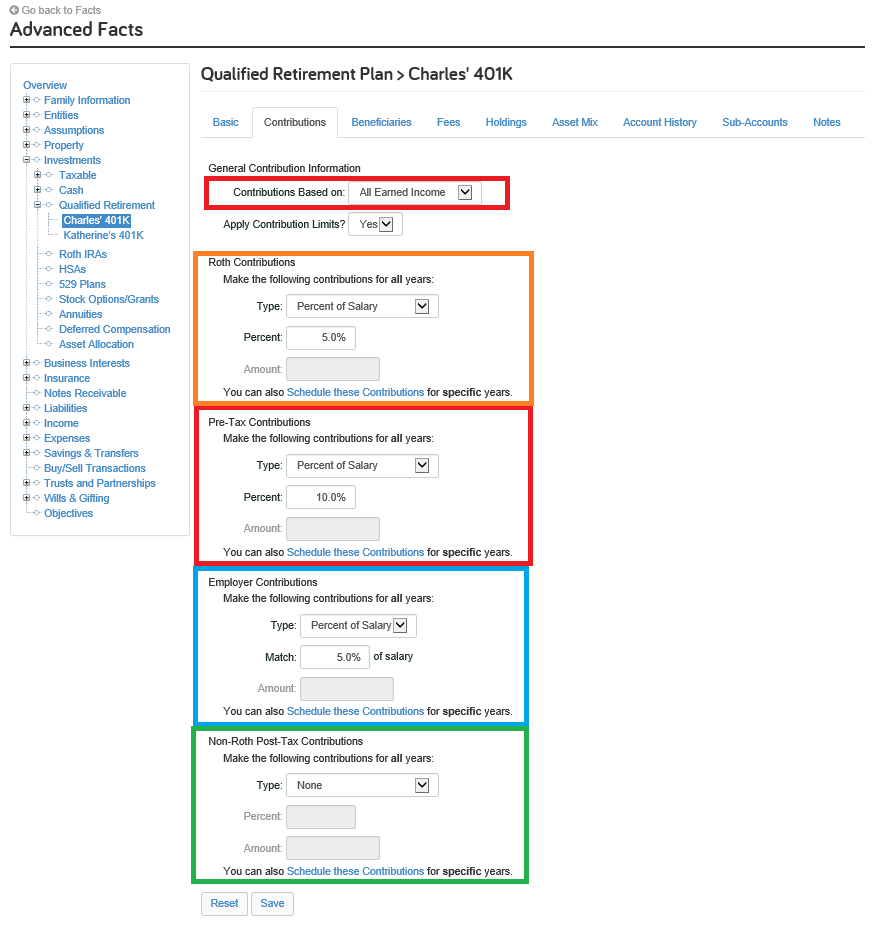

Next, you can use the Contributions tab to capture savings into this account. Please be aware though, that eMoney treats employee 401(k) contributions as salary deferrals, therefore a salary must be entered in the Income section. You can base contributions on one specific income fact, or you can choose “All Earned Income.” Choosing All Earned Income will tell the system to base the contributions on all of the salary/bonus of the individual who owns the account.

You can detail the amount of Roth Contributions, along with any employee pre-tax contributions, employer contributions, and Non-Roth Post-tax contributions. eMoney supports the current contributions limits for a profit sharing plan with a 401(k) feature. For 2017, the employee limit is $18,000, employer limit is $54,000 less the employee contribution. The catch-up provision available to individuals age 50 and older is supported as well, meaning individuals can contribute up to another $6,000 to their 401(k) account and still receive preferential tax treatment for those contributions.

To ensure the correct amounts are being contributed to each account, refer to the Cash Flow – Savings Report. For further detail on a particular account, use the Ledger report to see the total value as well as the tax basis associated with that account.