for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreOne of most (if not the most) common financial objectives for clients is securing and providing income for retirement. There are many different ways to answer those common questions such as, “When can I retire?” or “Am I saving enough for retirement?” but regardless of the formula or calculations used, eMoney can help clients visualize their current projection as well as the effect of different actions or plan changes on their overall retirement.

One great way you can visualize those projections is with eMoney’s family of Cash Flow Reports, which are very effective in terms of telling a client’s retirement story. There are various sub-reports that provide more detail on the different life stages. For example, the Savings sub-report will show how clients are accumulating assets via their own contributions as well as employer contributions. The Withdrawals and Detailed Withdrawals sub-reports, on the other hand, will show how assets are being utilized and distributed. Finally, the 5-Year Cash Flow sub-report condenses the full Cash Flow Report into 5 year segments, which may be easier for clients to digest.

[slideshow_deploy id=’12316′]

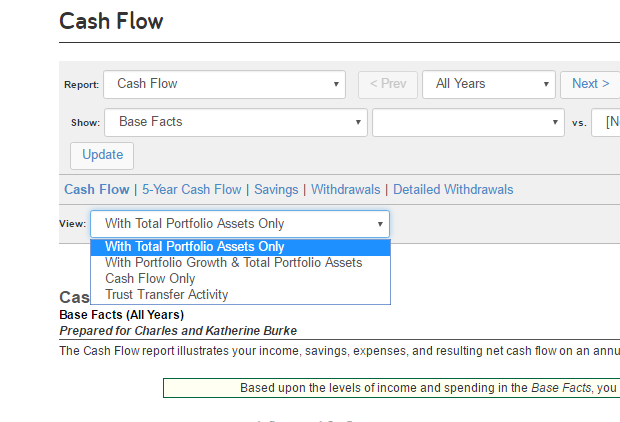

The beauty of the Cash Flow Report is the ability to click into different columns and see the numbers behind a particular figure. This helps focus in on the different types and amounts of income in a particular year, along with more details on the type and amount of certain outflows in a given year. One often over-looked capability in the Cash Flow Report is found in the “View” box underneath the 5 sub-report blue links. This field provides options that will increase or decrease the number of columns on the Cash Flow Report.

For retirement purposes, the most effective view is “With Portfolio Growth & Total Portfolio Assets.” This view will add two columns to the Cash Flow report: Portfolio Growth and Other Portfolio Activity. Using this view provides additional insight on how assets values are appreciating along with other transactions that effect the ending Total Portfolio Asset projection. If you desire to see the client’s total net worth in this report as well, turn on the view “Trust Transfer Activity”. This view will show activity related to any trusts in addition to adding a net worth column to the Cash Flow Report.

Using the Cash Flow family of reports, advisors can project a client’s current retirement plan and also create different scenarios that show different actions and decisions taken by a client and how they impact their overall retirement.