for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreWhat happens if I experience a health event or a disability that results in being unable to work? This is a scenario your clients may ask to examine so they know how it could impact their financial plan.

Today we’ll review how you can address this question by utilizing a Disability Occurs What-if scenario and the Disability Insurance set of eMoney reports.

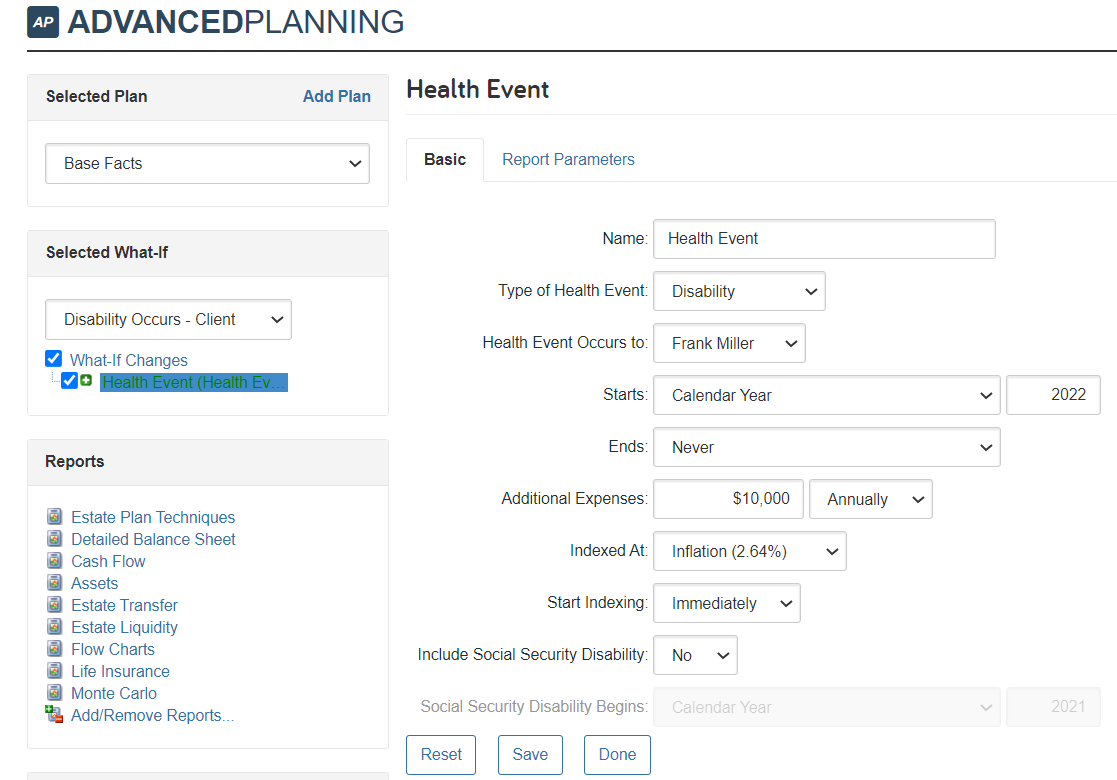

To generate the Disability Insurance reports you first need to create a Disability Occurs What-If scenario. Speak with your client about their primary injury concerns. Do they work in a dangerous environment? Are they adventurous on the weekend? Gather as much information as you can to fine tune the additional expenses, duration, and other variables within the What-Ifs health event.

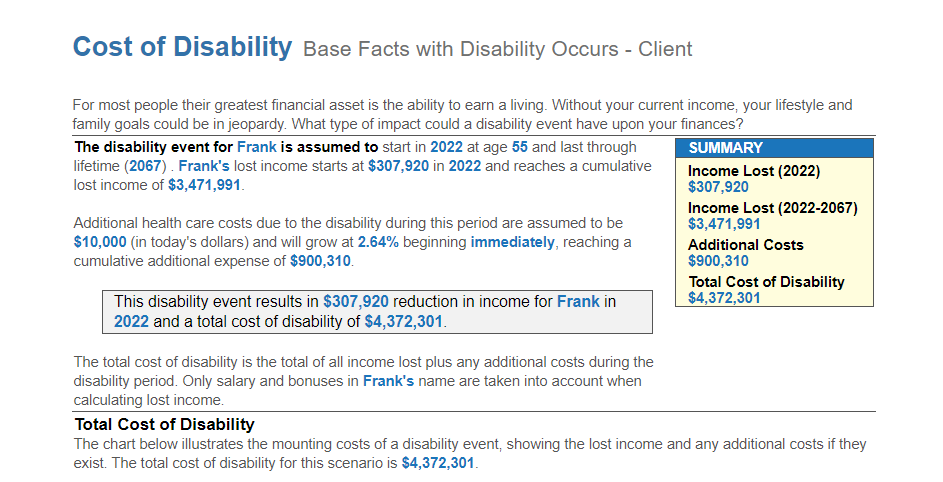

You can now start by applying the What-if to the Survivor Costs and Costs vs. Resources reports and review your client’s expenses and resources with them.

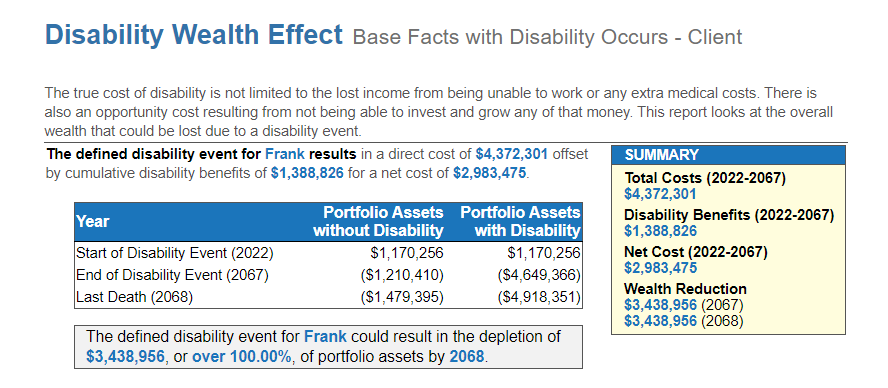

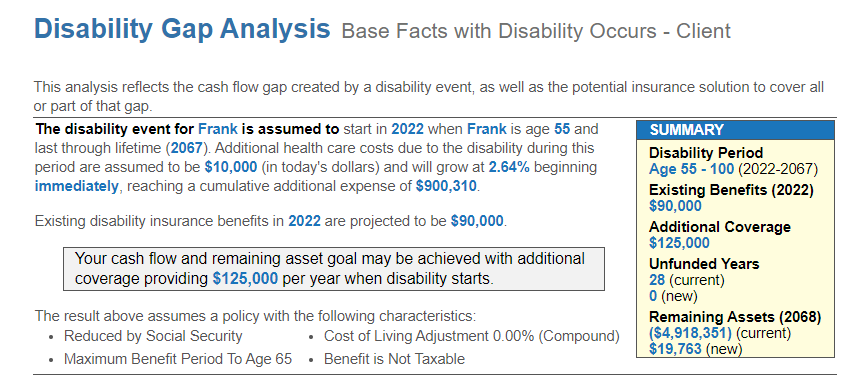

Once they understand the totals costs, your next step is to fine tune their desired level of coverage.

Set the Assets Remaining field based on your client’s preference. You can solve for the same number of assets remaining as entered in their base case, essentially solving for asset replacement or aim for a specific asset level.

With these three reports, you can encourage your clients to consider the financial risks of certain unexpected health events and start planning the proper insurance coverage.

To learn more about insurance planning, check out Planning for Unexpected Events with What-Ifs. This post and webinar recording will walk you through where to access and edit your health event What-ifs and how to utilize them when presenting to clients.