for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreEvery client who has ever come into your office for financial advice did so because they have questions. Questions they feel ill-prepared for and that your expertise makes you uniquely qualified to answer. Even though every client is different, over time you begin to see trends.

Below we discuss five common questions your clients want answers to, and how to tackle them, once you’ve created the base case for your clients in eMoney. Keep reading or jump ahead using the links below.

“Are we on track for retirement?” is often the first question a client will ask. Fortunately, with your suite of retirement planning reports, you can prepare for client conversations and use these visual charts to help answer this question and more.

Let’s target a few retirement-related questions you may encounter and the accompanying reports that will satisfy your clients’ inquiries. To access a client’s retirement reports, go to Reports > All Reports > Retirement Planning. From here, you’ll see a drop-down menu of report options.

This may prompt you to walk your clients through how much they are spending versus what’s coming in to offset those expenses.

You can touch on building retirement assets to show clients how the actions they take today impact their future retirement savings.

Note: A quick Advanced Plan showing the impact of increased savings or retirement plan contributions can show clients how saving a little more each month has a profound impact on their assets at retirement age.

Pull everything together with a complete summary of all the information you’ve reviewed so far while providing options for how to proceed with meeting your client’s goals.

There are many other methods and reports available in eMoney for answering that common client question, “Am I on track for retirement?” but the above reports are a great start. If you have a full financial picture in the client’s base case and can demonstrate a plan of action to present these key reports, you should provide your client with some clarity around this valuable topic.

This is a common question your clients may ask and hope to review to see how it could impact their financial plan. Address this question by utilizing a premature death What-if scenario and the Life Insurance set of eMoney reports.

Before you begin presenting with Life Insurance reports, create a premature death What-if. To learn more, check out Planning for Unexpected Events with What-ifs. This post and webinar recording will walk you through where to access and edit your What-ifs and how to utilize them when presenting to clients.

Now you’re ready to apply the What-if to reports.

Let’s target some of the life insurance-related questions you may encounter and the accompanying reports that will satisfy your client’s inquiries. To access, go to Reports > All Reports > Life Insurance. Here, you’ll see a list of report options across the top of the reports page.

Start by reviewing your client’s expenses and resources with the Survivor Costs and Costs vs. Resources reports. You can apply the premature death What-if to both reports.

Now that your client has a general understanding of the costs that could be incurred by the family if a death occurs, and resources available to offset those costs, it’s a good time to move on to the Gap Analysis report.

Finish up by showing your client how the additional insurance impacts their Costs vs. Resources.

While there are numerous other reports available for Life Insurance, these four will provide a solid base on which to build.

It’s important to have your education expenses clearly defined and funded in your client’s Fact Finder before attempting the use the Education Planning suite of reports to answer this question.

There are a few key settings within the education expenses to be aware of, including:

Review these expense settings carefully, and once you have a strong base case for your education plan, move onto reports that will answer questions about education funding.

Now that you’ve had the opportunity to review costs and funding if a shortfall has been identified, it’s the perfect time to explore potential solutions to any funding shortfalls in the Options for Meeting Needs report.

There are many additional reports that can break down the funding and spending details or analyze the cost of waiting to fund but these provide the foundation of any education planning report in eMoney.

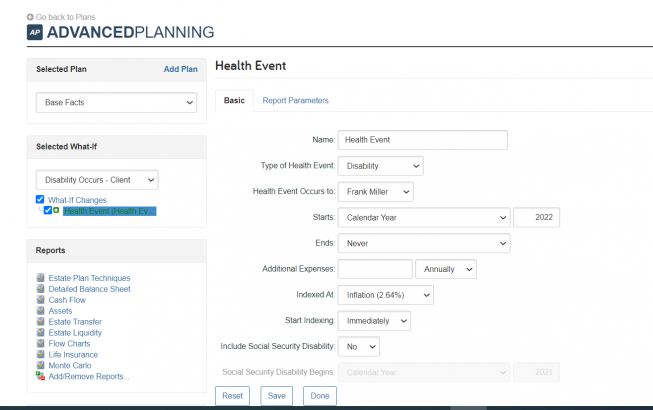

What happens if I experience a health event or a disability that results in being unable to work? This is a scenario your clients may ask to examine so they know how it could impact their financial plan.

Address this question by utilizing a Disability Occurs What-if scenario and the Disability Insurance set of eMoney reports.

To generate the Disability Insurance reports you first need to create a Disability Occurs What-if scenario. Speak with your client about their primary injury concerns. Do they work in a dangerous environment? Are they adventurous on the weekend? Gather as much information as you can to fine-tune the additional expenses, duration, and other variables within the What-ifs health event.

Next, apply the What-if to the Survivor Costs and Costs vs. Resources reports and review your client’s expenses and resources with them.

The Cost of Disability Report breaks down exactly how much this disability health event will cost—not just in income lost in the current year but also over the client’s entire lifetime.

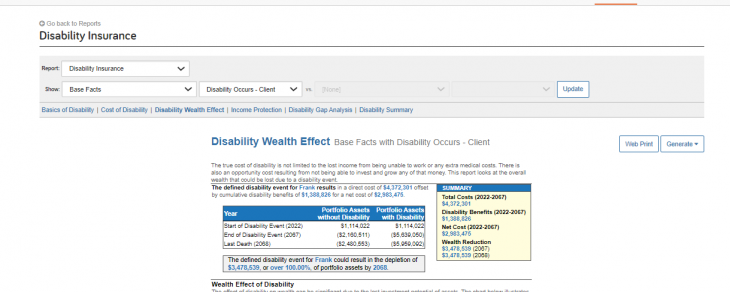

The Disability Wealth Effect Report shows the overall wealth lost. It demonstrates that the true costs of disability—beyond the lost income and extra medical costs—is the opportunity cost resulting from not having been able to invest and grow any of the money spent. This report drives home the real costs accrued over your client’s entire lifetime due to an injury.

Once they understand the total costs, your next step is to fine-tune their desired level of coverage.

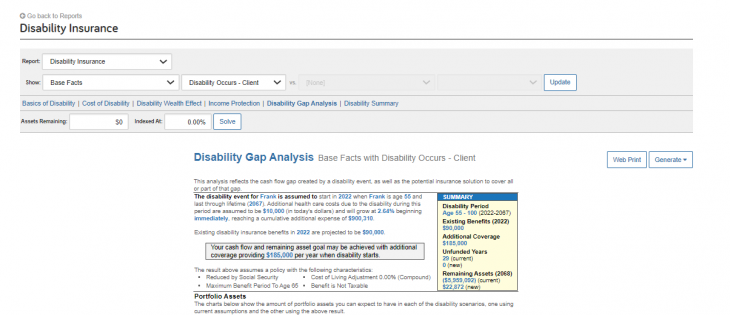

The Disability Gap Analysis Report reflects the cash flow gap created by a disability event and any potential insurance required to cover the solution. Be sure to set your desired level of assets remaining because the Disability Gap analysis report can easily show that a client needs no additional coverage when it’s only solving for them having greater than $0 in assets remaining at death.

Set the Assets Remaining field based on your client’s preference. You can solve for the same number of assets remaining as entered in their base case, essentially solving for asset replacement or aiming for a specific asset level.

With these three reports, you can encourage your clients to consider the financial risks of certain unexpected health events and start planning the proper insurance coverage.

Any Long-Term Care (LTC) planning should start by creating an LTC is Needed What-If scenario. Similar to disability, the LTC is Needed What-If creates a health event that takes place over a specific time period and creates a number of variables including an additional expense.

Note: Be sure to complete the Report Parameters in the What-If to use the Cost-Benefit of Long-Term Care Insurance report. The Long-Term Care Insurance reports look for this What-If scenario to be applied to solve any LTC insurance need.

If you have questions about LTC costs, the Cost and Payment Options report discusses costs based on the Genworth Financial Cost of Care Survey 2021.

Once you’re comfortable with your projected What-If scenario begin by discussing the Cost of Long-Term Care.

Finally, it’s possible that the same dollar invested in coverage could be better invested today. That’s where the Cost-Benefit of Long-Term Care Insurance report comes in.

Check out the Reports interactive user guide to learn more about all of the available reports or sign up for our Intermediate Series webinar Diving Deeper with Reports.