for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreAnnuities are a great way to protect a client’s retirement lifestyle. But because of some of their complexities, adding them to the eMoney system takes some guidance. However, once you get the hang of it, there’s basically no product that you can’t model.

eMoney has specific functionality to support all types of annuities from immediate (SPIA) annuities all the way through Rider, High Water Mark guaranteed income annuities.

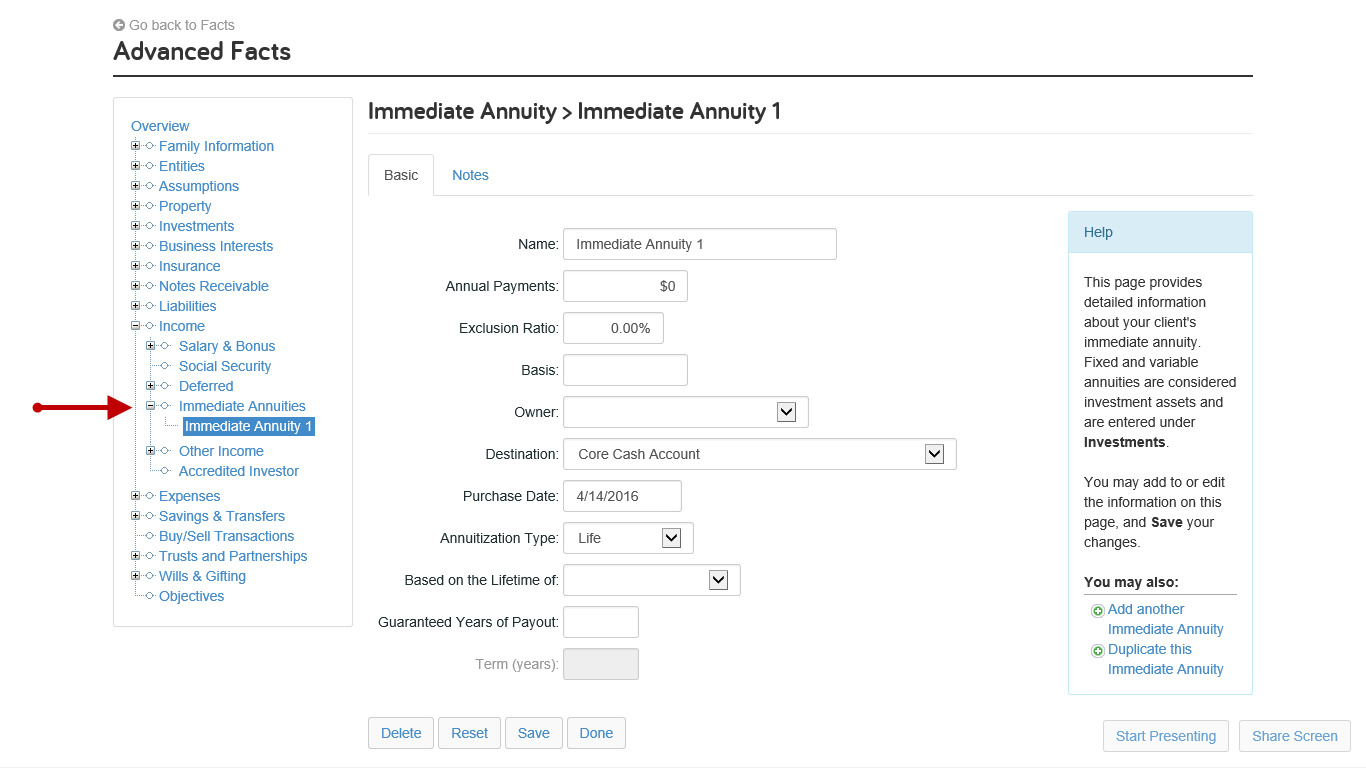

Previously purchased SPIAs can be entered under Income -> Immediate Annuities.

All deferred annuities (no income as of today) should be entered under Investments -> Annuities. If it is going to be Annuitized at any point in the future, use the Annuitization Begins field on the Basic Tab of the Annuity.

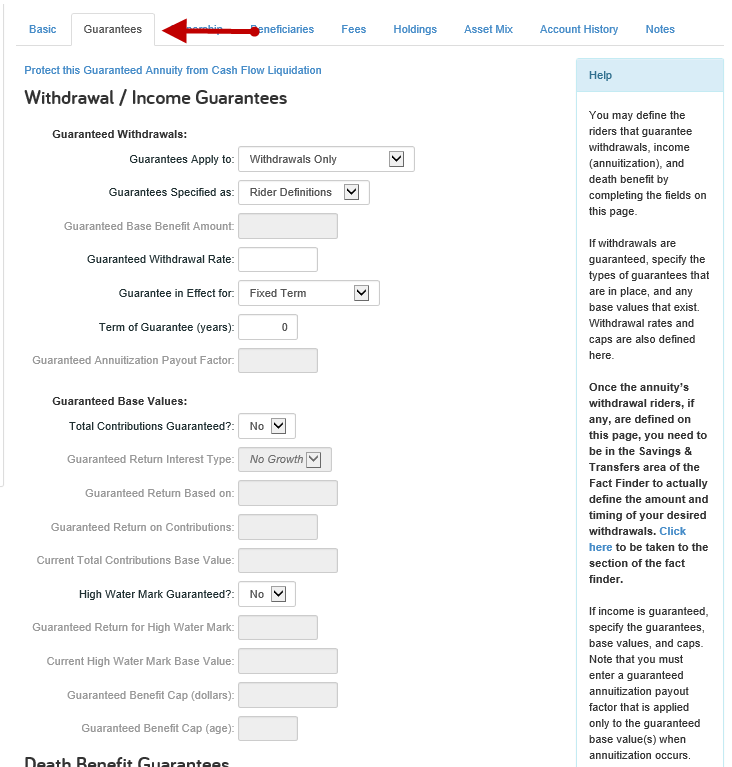

If you have guaranteed riders or high water marks on a particular annuity, there are two major steps that you must do in order to have the annuity payout as per your contract. The first major step is to fill out the guarantees tab.

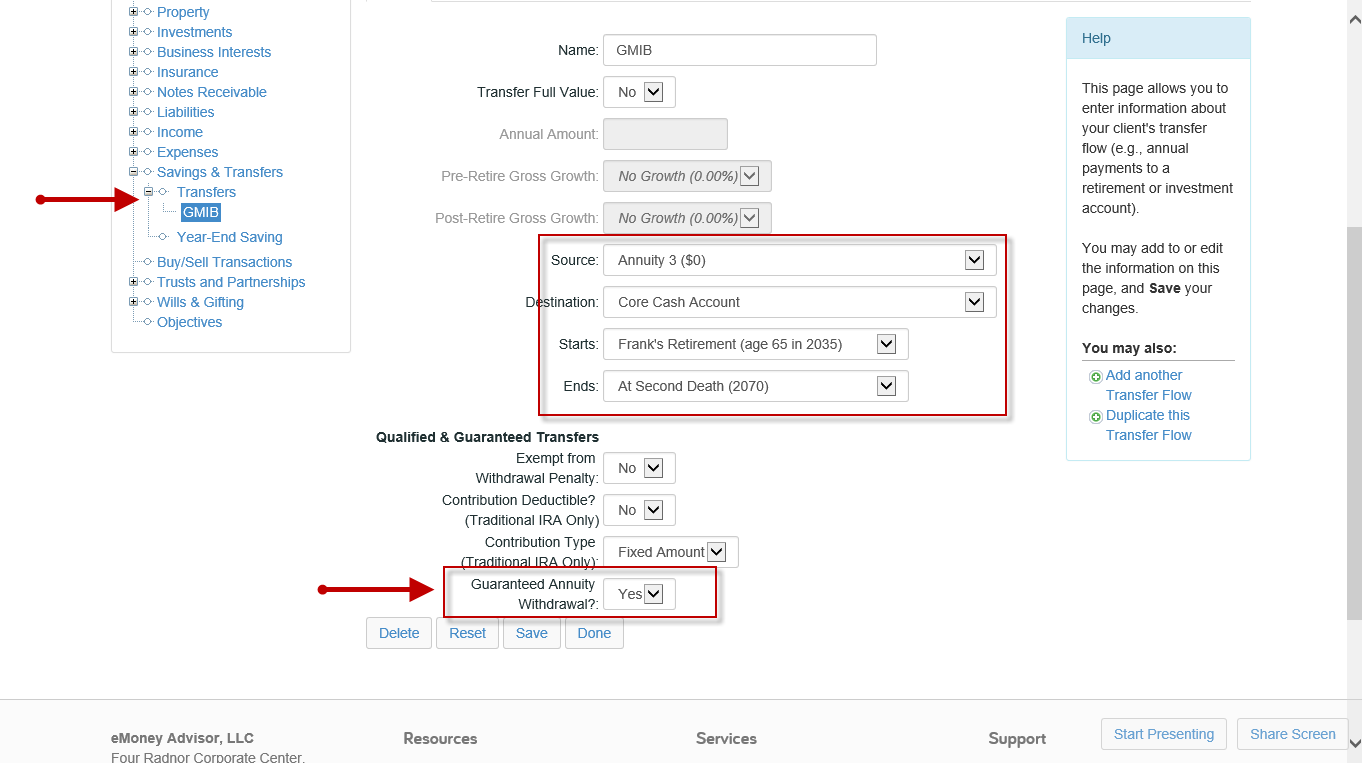

Next, create a transfer flow to tell the system when you would like to start your guaranteed income (withdrawal). The key pieces of the transfer flow is that you first select the annuity as the Source account, while leaving the core cash as the destination. Second, elect when the income should start and end.

Finally, toggle the Guaranteed Annuity Withdrawal dropdown to Yes. This tells the system to take the amount calculated from the Guarantees tab on your Annuity.