for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreFoundational Planning is a solution for helping clients who have less complex planning needs. As the name implies, the tool acts as the foundation for establishing a planning-led relationship. It requires fewer inputs and offers step-by-step guidance throughout the data gathering process giving you time to produce more plans for more clients. Best of all, as client finances mature, you can continue to meet their planning needs by seamlessly moving them to our more advanced solutions.

Keep reading below to learn more about the different features of Foundational Planning or jump ahead to the topic of your choice.

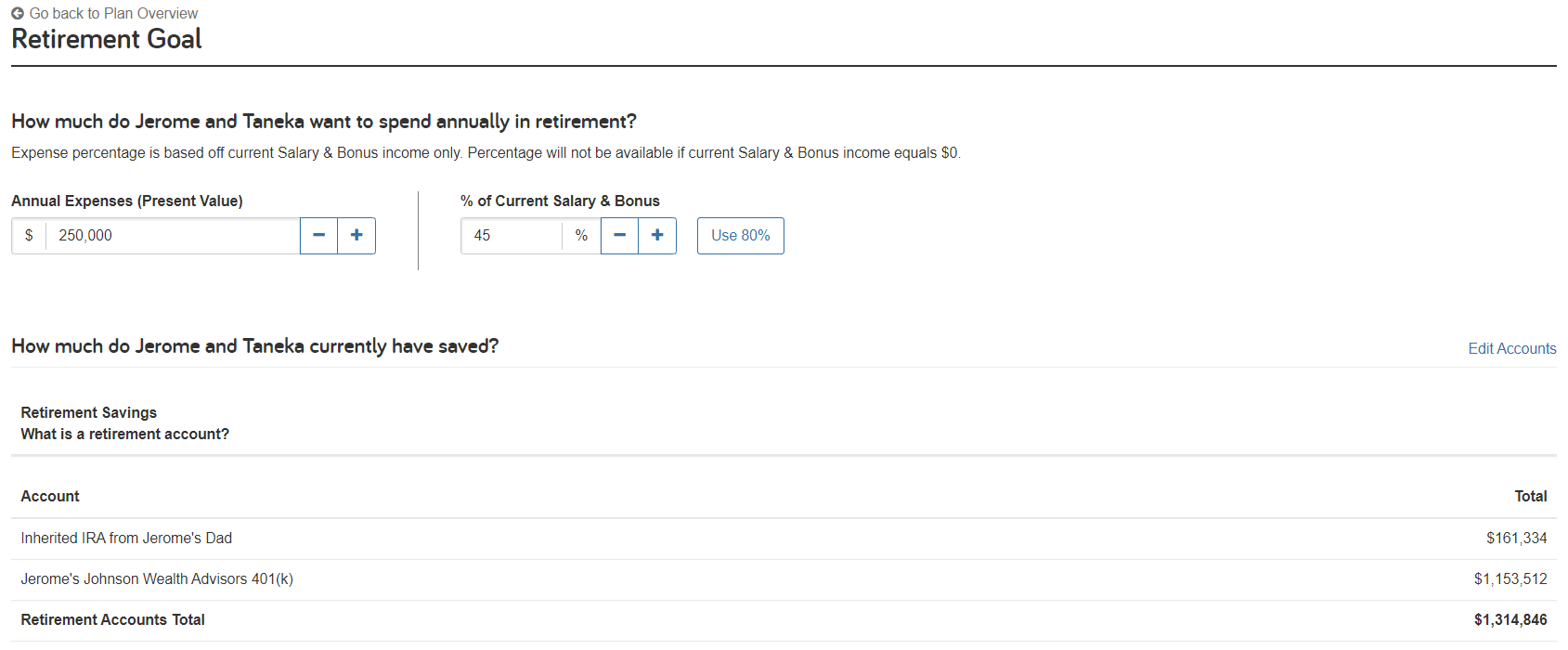

Retirement is an essential goal for all clients and will always be a major focus of their financial plans. Let’s walk through how to enter a Retirement Goal and set a Proposed Plan in Foundational Planning for your clients.

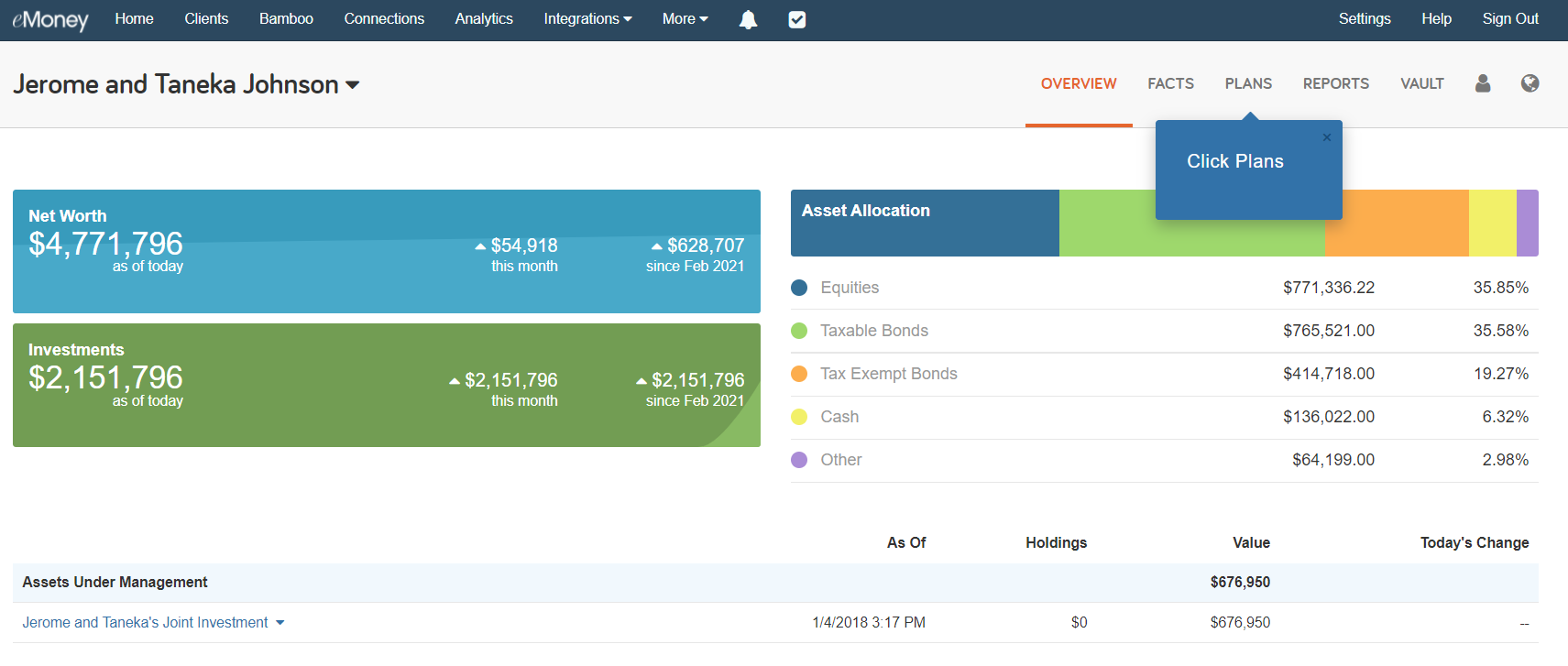

Start by navigating to the Client Overview page. From here click on Plans.

Next, select the Retirement Goal option under Goals.

This opens the Retirement Goal module where you can review and update your client’s goal information. Maybe your clients want to retire at 63 instead of 65. Make the necessary adjustments and click Next Step.

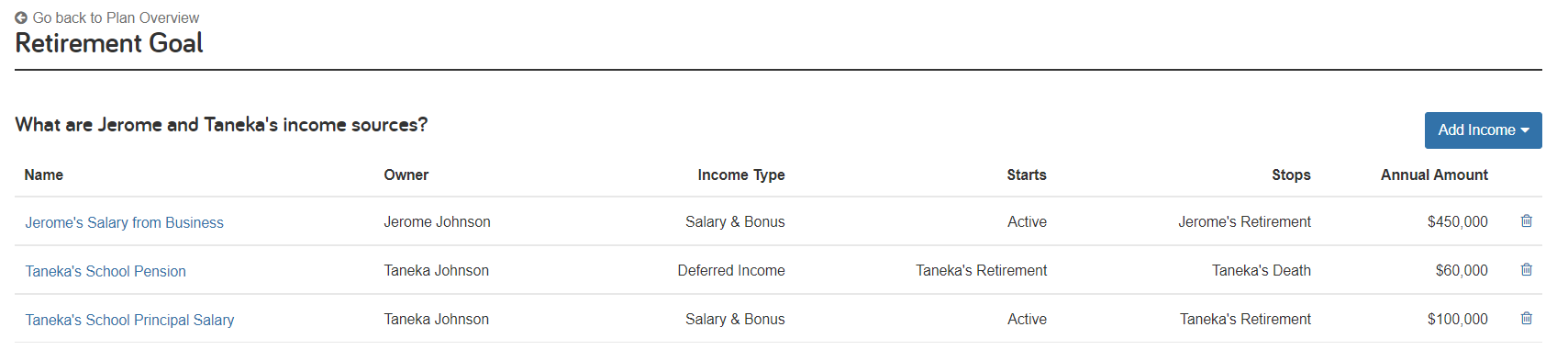

Your client’s current salary and bonus income are used to estimate future social security income and retirement living expenses. Future income can also help fund retirement living expenses. Any existing income from Facts will be present; however, if you want to add additional income, you can do so by clicking Add Income in the blue box in the upper right corner.

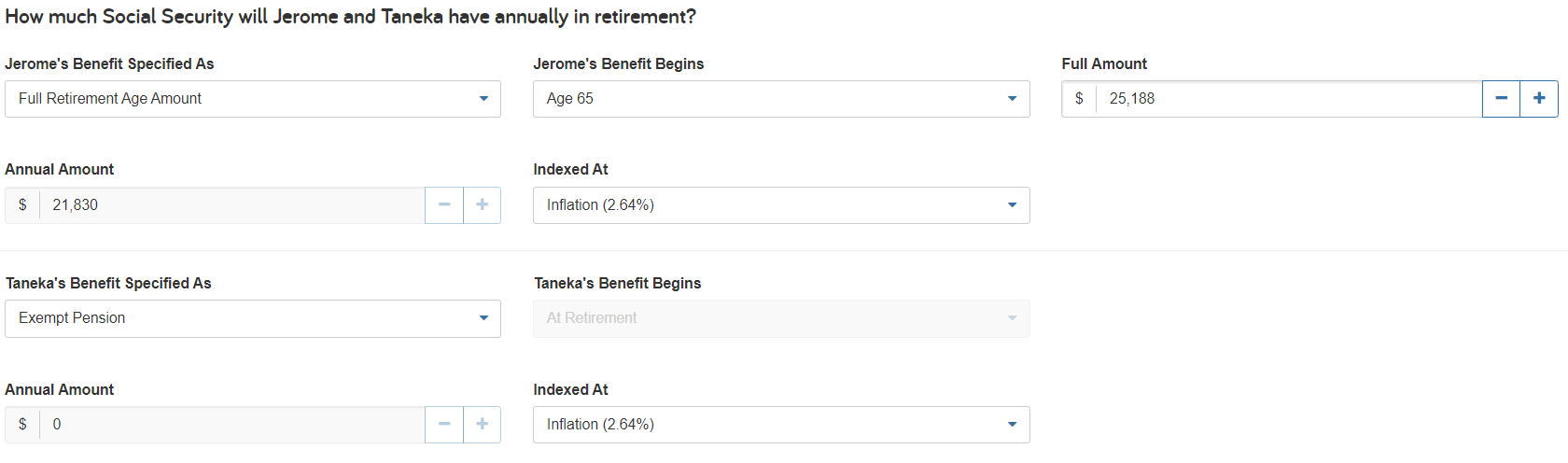

Now scroll down and review your client’s Social Security information. Ensure it accurately reflects your recommendations for how and when they should apply for benefits during retirement.

Next, review your client’s retirement and other accounts. All accounts are used for retirement by default, but certain tax-advantaged accounts may be used first.

If you notice any accounts are missing, click Edit Accounts to add current assets that will be used to fund living expenses in retirement.

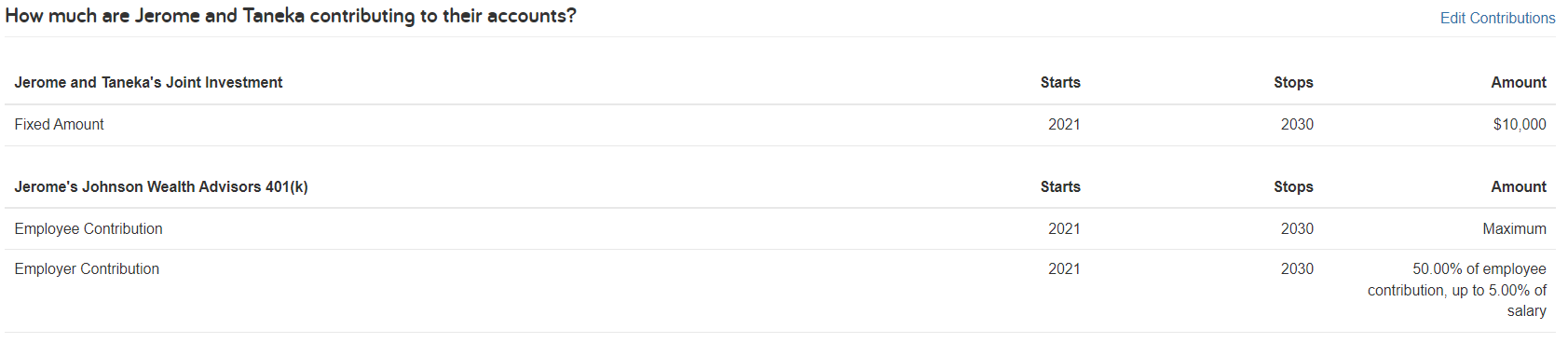

It’s important to review how much your client is contributing to their accounts to fund expenses in retirement. If you notice any contributions are missing below, click Edit Contributions.

Below you can see the results of your client’s Current Situation based on the information entered in the previous screens. Try toggling between the different chart views to help you fully understand your client’s retirement readiness.

Unfortunately, from this example, the client will fall short. Click on Details and then More Info to see a more detailed breakdown of where the client falls short and gain a better understanding of their needs.

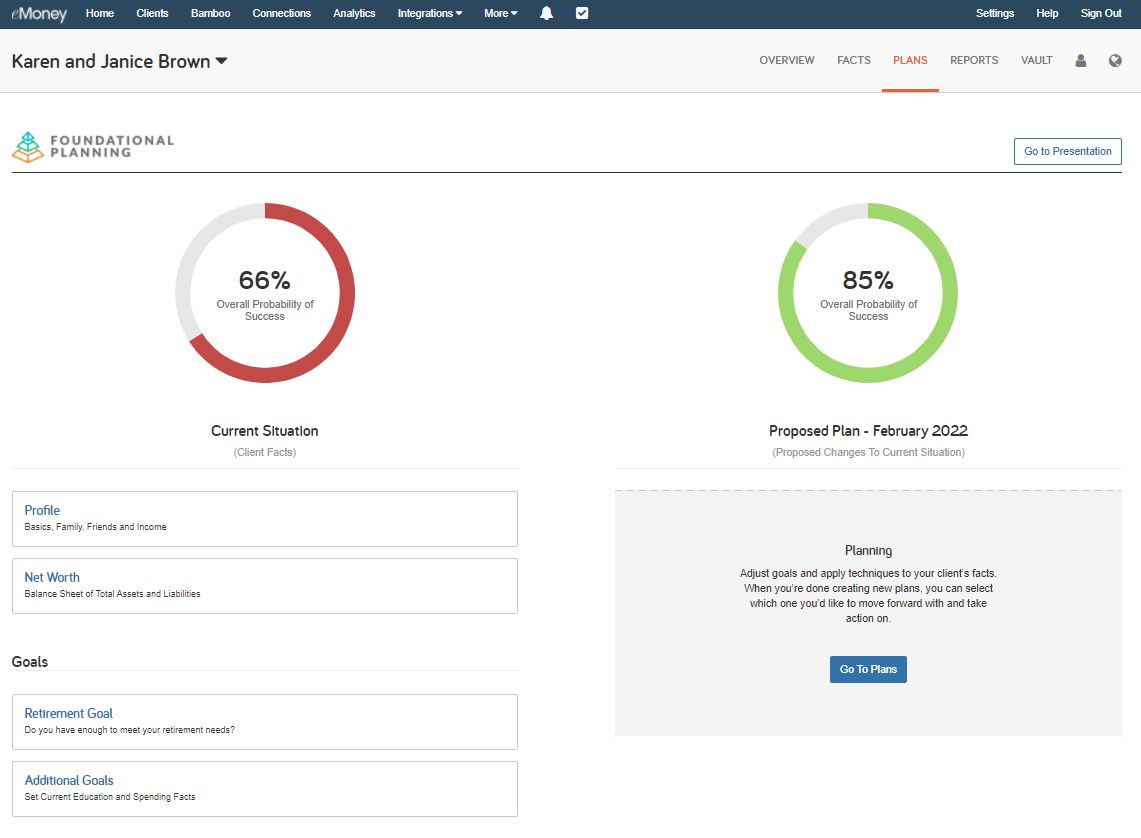

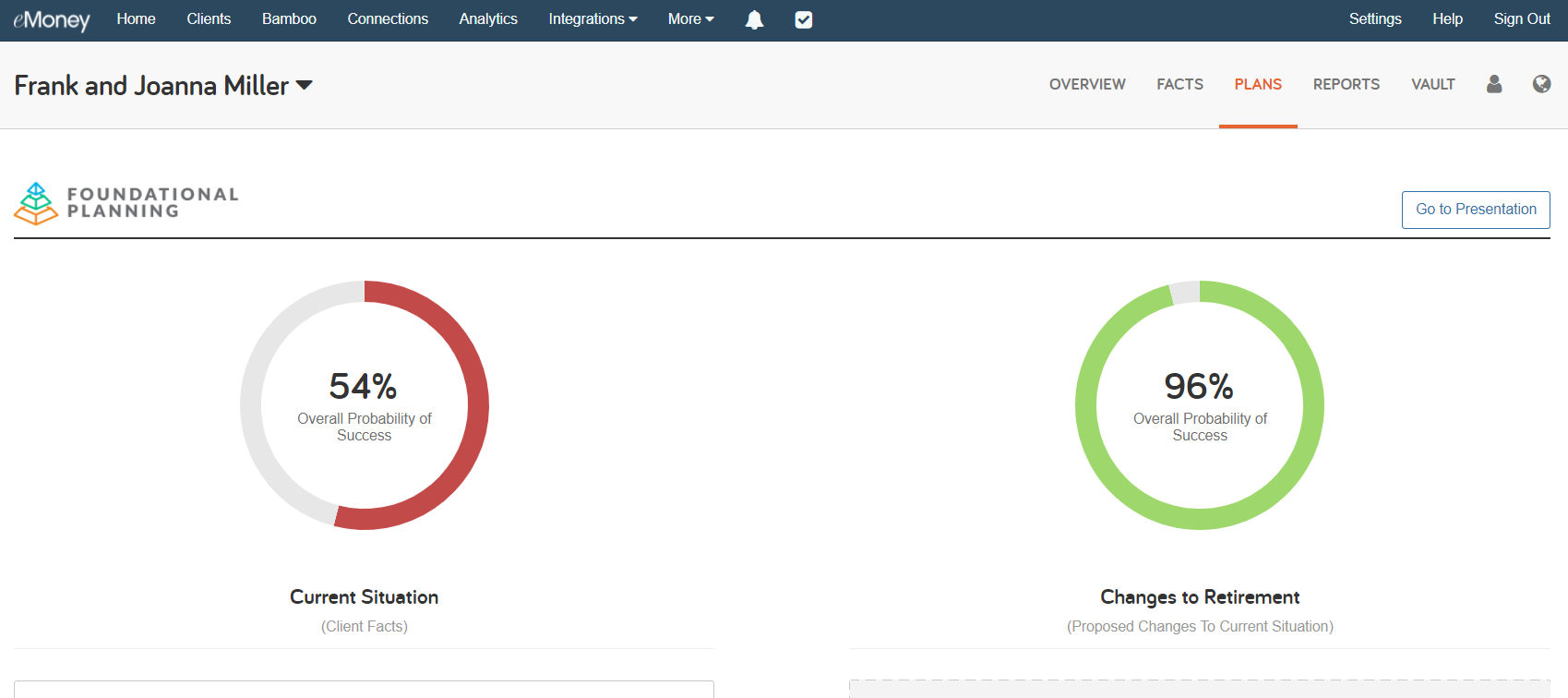

Now, you can click back on the Plans tab, go back to the retirement plan to see a side-by-side view of the Current Situation and the Proposed Plan.

From there, you can make adjustments to the Proposed Plan to maximize their probability of success. See how in this example, by adjusting their retirement age from 63 to 65 and reducing their annual expenses from $250,000 to $200,000 their probability of success went from 13 percent to 74 percent.

Once you make your changes, select Set Plan as Active, on the bottom of the screen, so you can review it with your clients.

Foundational Planning makes it easy to engage prospects and clients in planning-led discussions that can help them prepare for every life stage!

Millennials, also known as Gen Y, were raised with technology from a young age creating key behavioral differences from previous generations.

Millennials grew up with computers in their schools and cell phones in their hands.

They have also faced a multitude of financial obstacles, as many graduated during the 2008 recession with record-high student loan debt and the inability to find a job in their chosen career. So it’s no surprise this generation has different lifestyles, professional priorities, and habits compared to the generations before them.

With a simplified process for creating goals beyond retirement, Foundational Planning is a great way to work with millennial clients.

Note: Additional Foundational Planning training resources are available at the end of this post.

Once you have all the client’s information, whether entered through Facts or collected via the Client Site, go to the Plan tab in their Client Overview.

Under the Goals section, you can enter essentials like saving for retirement, saving for a home, still being able to travel, paying off credit cards, etc.

Start with the Retirement Goals since most Millennials are not saving enough for retirement. Once you select Retirement Goals start working your way through the questions being asked. This is where you can take actions like increasing or decreasing the retirement age, adding additional income, or decreasing expenses to see what can help your client hit their goals. Hit Next Step after each change until you get to the Analysis page.

And then select Go to Planning.

This is where you can see a side-by-side comparison of your client’s current plan versus the one you just made.

Once you are satisfied with the results, you can scroll to the bottom of the page and hit Set Plan as Active.

Now every time you go to Plans you can see the side-by-side comparison. If your client wants to set more goals, such as saving for a house, select Additional Goals under the Goals section.

Click Add Goals.

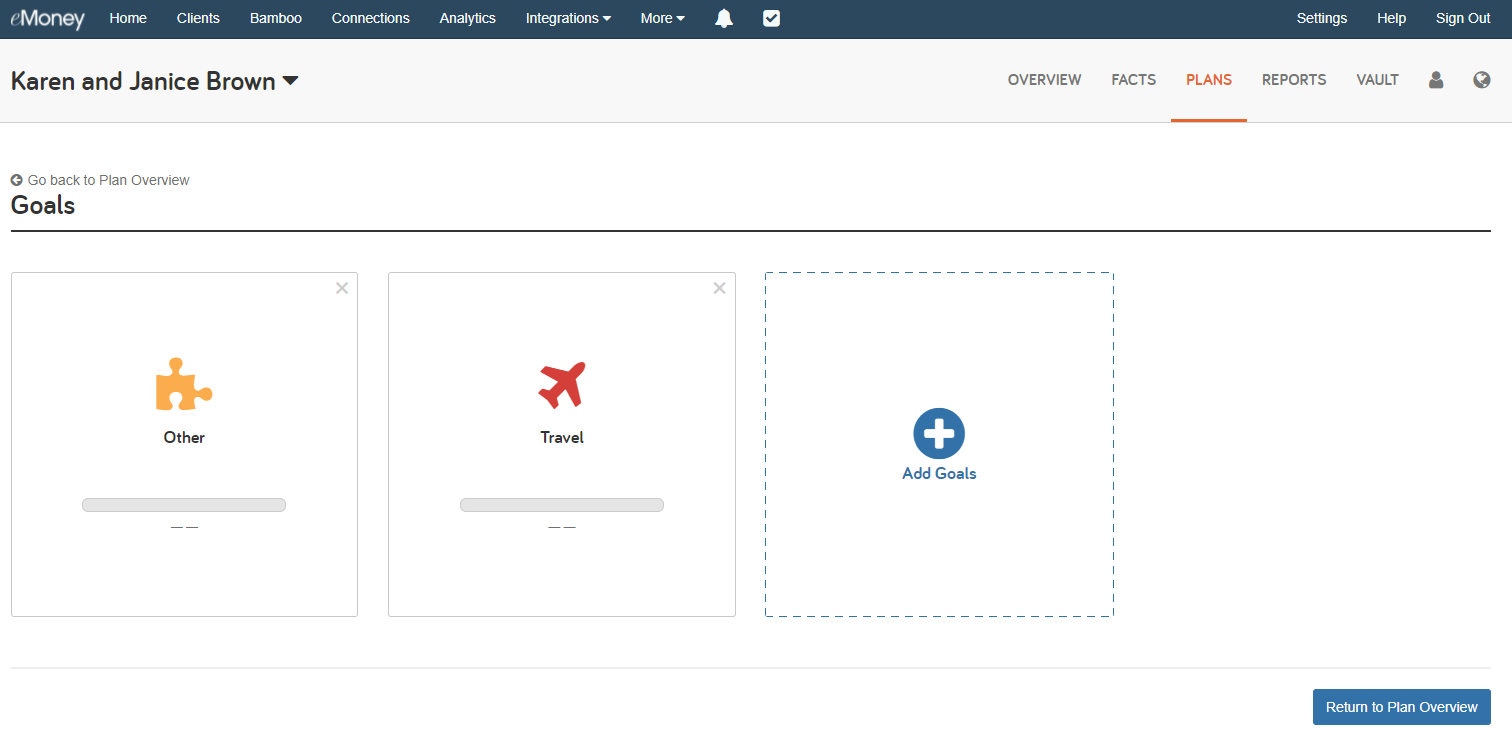

This is where you can enter traveling, saving for a home, and anything else your client is interested in.

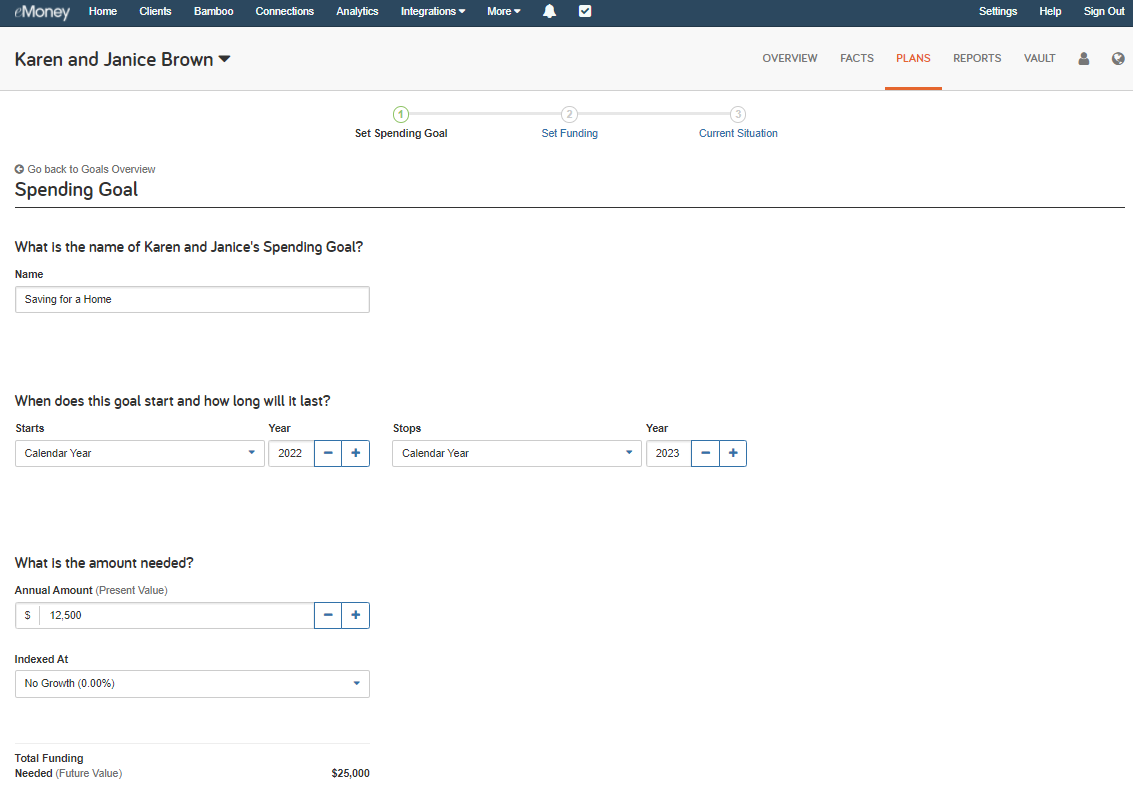

Once they are entered you can click on each box and provide more detail about each goal. Here you can change Other to Saving for a Home. Maybe they need $25,000 for the down payment and closing costs and want to move by 2024. Enter the appropriate information below and click Save, and then Next Steps.

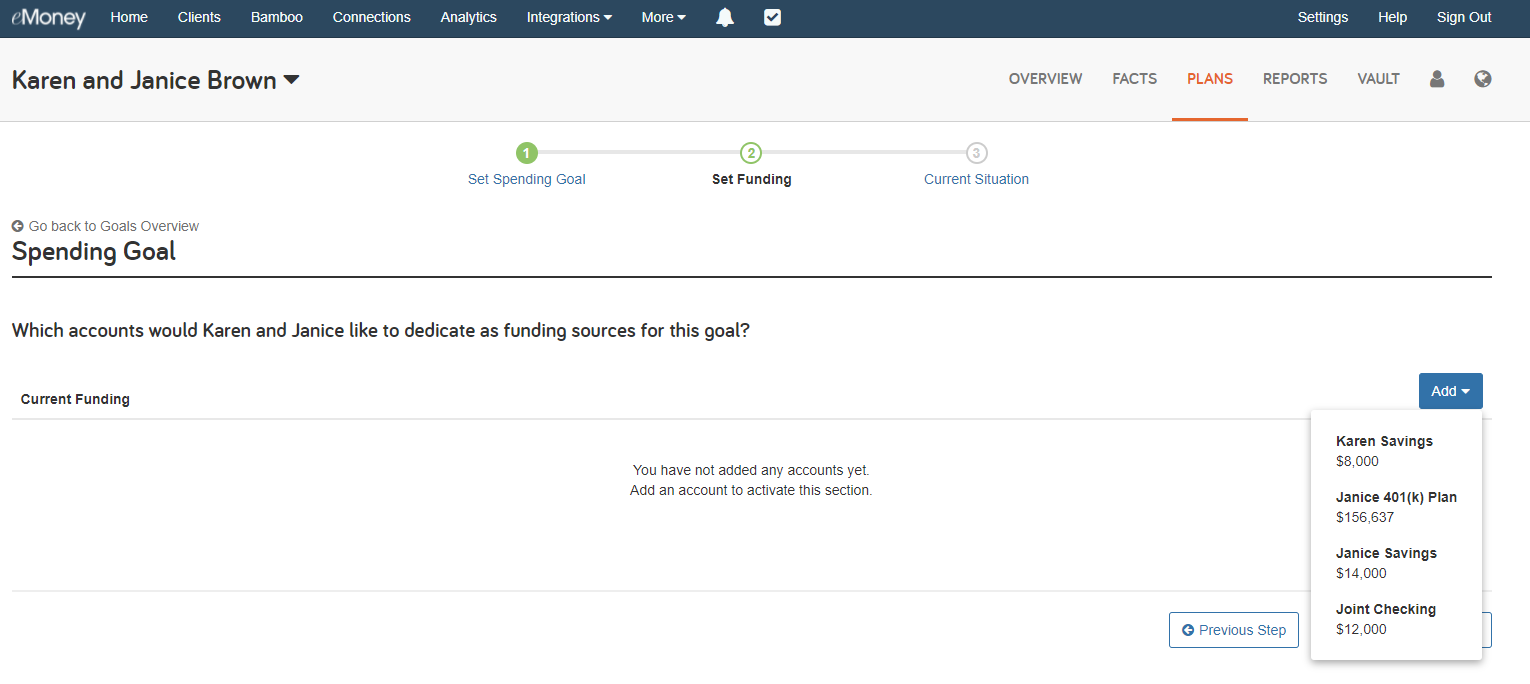

Next, you must select a funding source. Select Add and you will see all options available based on the facts and income entered. For this example, use savings from both Karen and Janice.

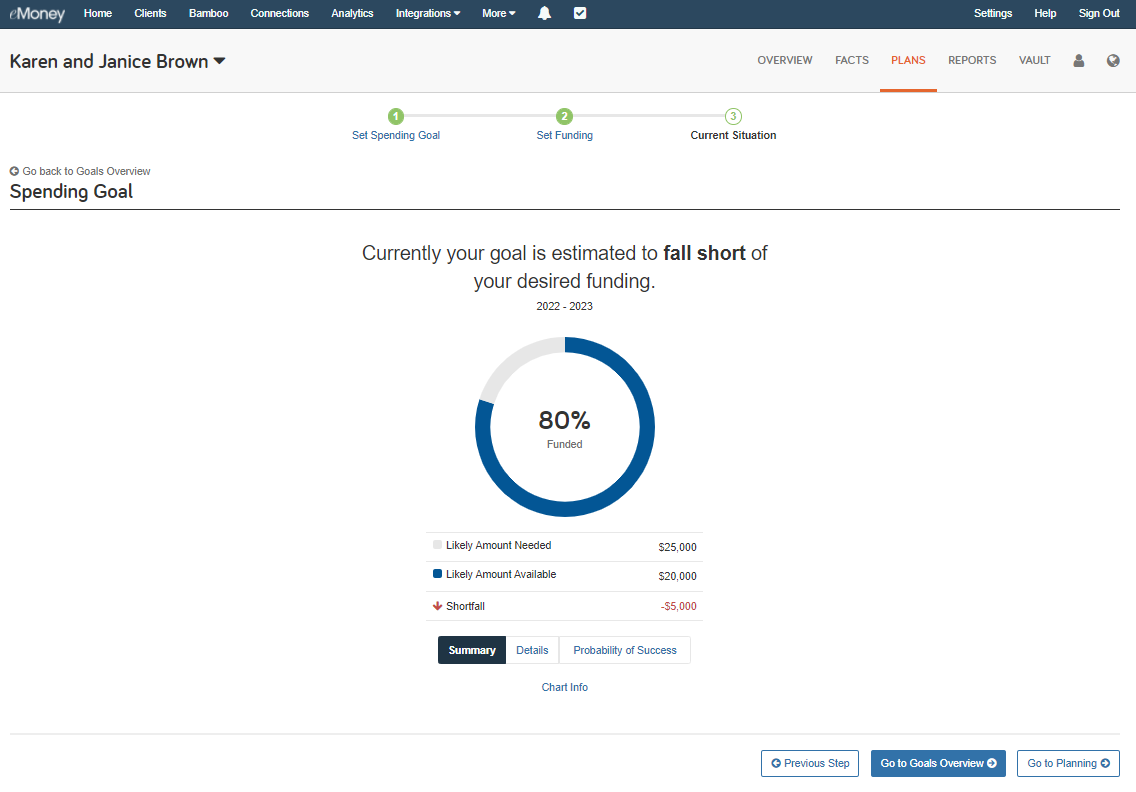

Once added, click Next Steps to see they will fall short of their goal.

Select Go To Planning to get more information on the breakdown of their goal. This is where you can make changes as you did for the Retirement Goal, and show the client what they will need to change to meet their goal. For this example, the annual amount was lowered and the funding accounts were changed to get them to their goal.

To view the other goals, change the topic in the left corner, where it says Selected Topic, and change from Saving for a Home to Travel or view the retirement goal.

You can also select Go to Presentation.

Select all the presentation materials you wish to save for your client. You can view the online version if you are meeting the client in person, or download the materials and save them to the vault for your client to view from their client site.

Tech-savvy Millennials will enjoy using the client site to view everything in one place, build their goals, and track their progress as they mature through Foundational Planning to become Advanced Planning clients as their portfolio grows!

Protection planning is important to many clients–if something happens to me, will my spouse be taken care of? Can we still achieve our financial goals? Answering these questions can provide your clients peace of mind that their affairs are in order no matter what happens.

Through the Life Insurance Gap Analysis, you can show your clients if their current coverage and other resources adequately protect their families. This module will help determine the survivor’s ability to maintain their desired standard of living and how much life insurance they need to cover any shortfall.

Using the Life Insurance Gap Analysis module in Foundational Planning is simple. Just complete the four simple steps shown below to generate the Gap Analysis.

An often under-utilized feature of the Foundational Planning proposed plan is the ability to include a recommended reallocation of assets. This change can have a powerful impact on a client’s probability of success.

Keep reading below as we discuss best practices for generating the recommended portfolio with Foundational Planning and how to apply the recommended reallocation to a Proposed Plan.

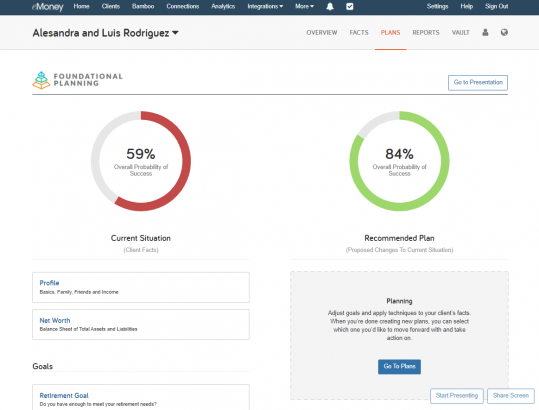

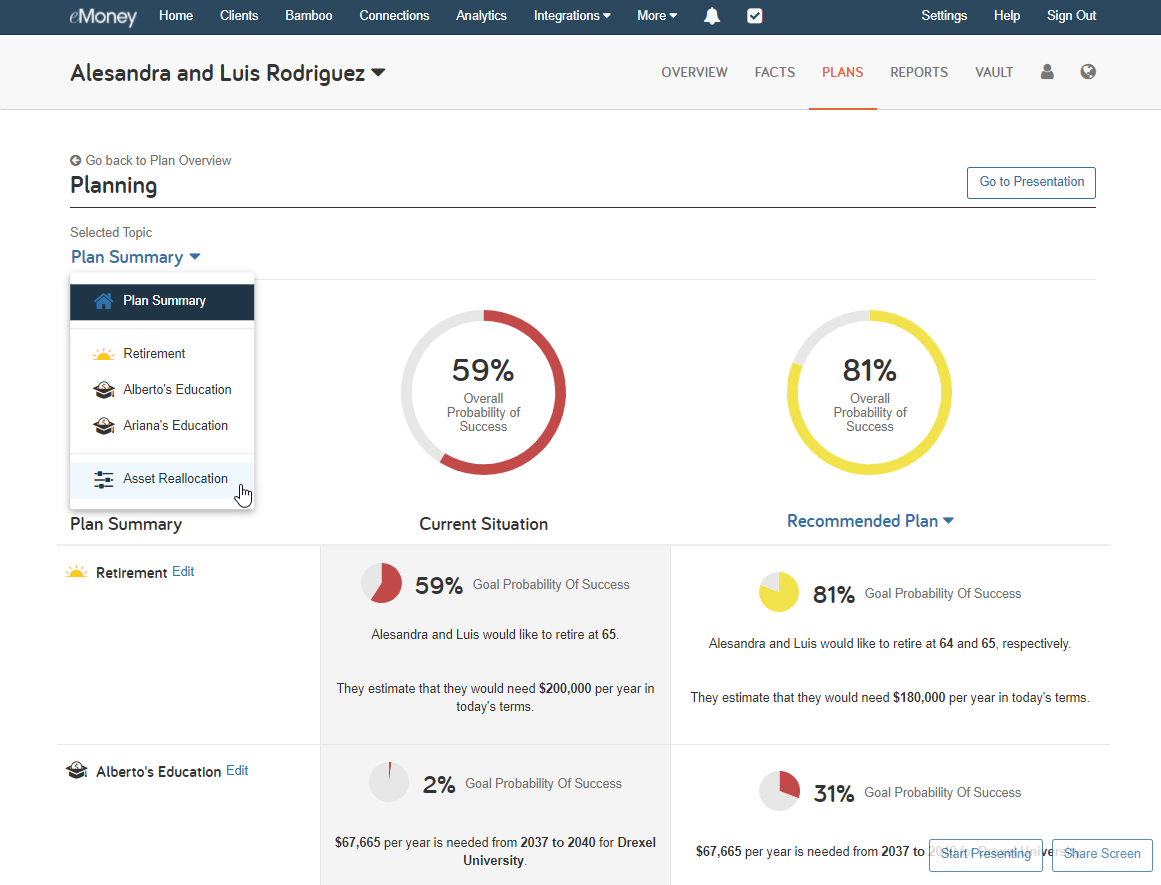

For this example, we’ll start with the sample clients Alesandra and Luis Rodriguez. The Rodriguezes are a young family with two small children. They are both high earners but are not on track for retirement, especially when factoring in paying for their children’s educations.

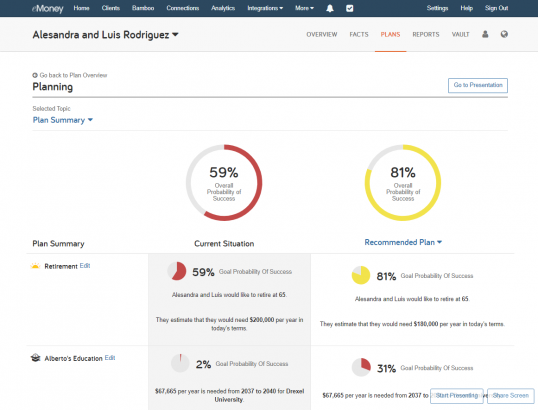

The pre-built Recommended Plan for the Rodriguezes already calculates to a 95% probability of success. However, this plan requires them to wait until age 68 to retire. If they want to retire earlier, say 65, they drop out of the “green” zone to only an 81% overall probability of success.*

This success gap presents a perfect opportunity to investigate whether their assets are appropriately allocated based on risk tolerance.

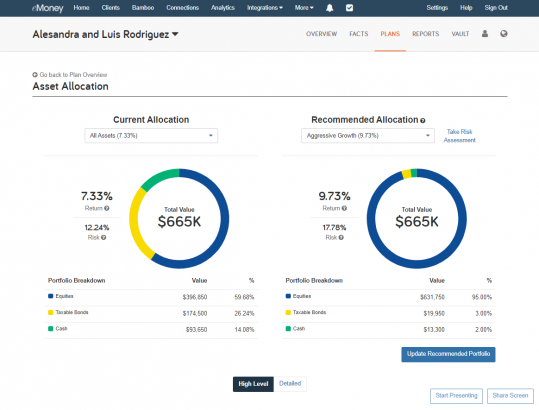

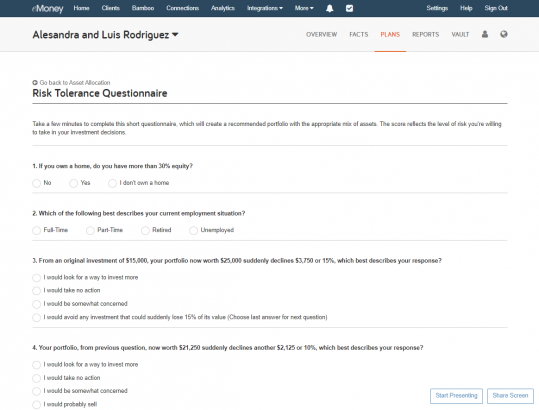

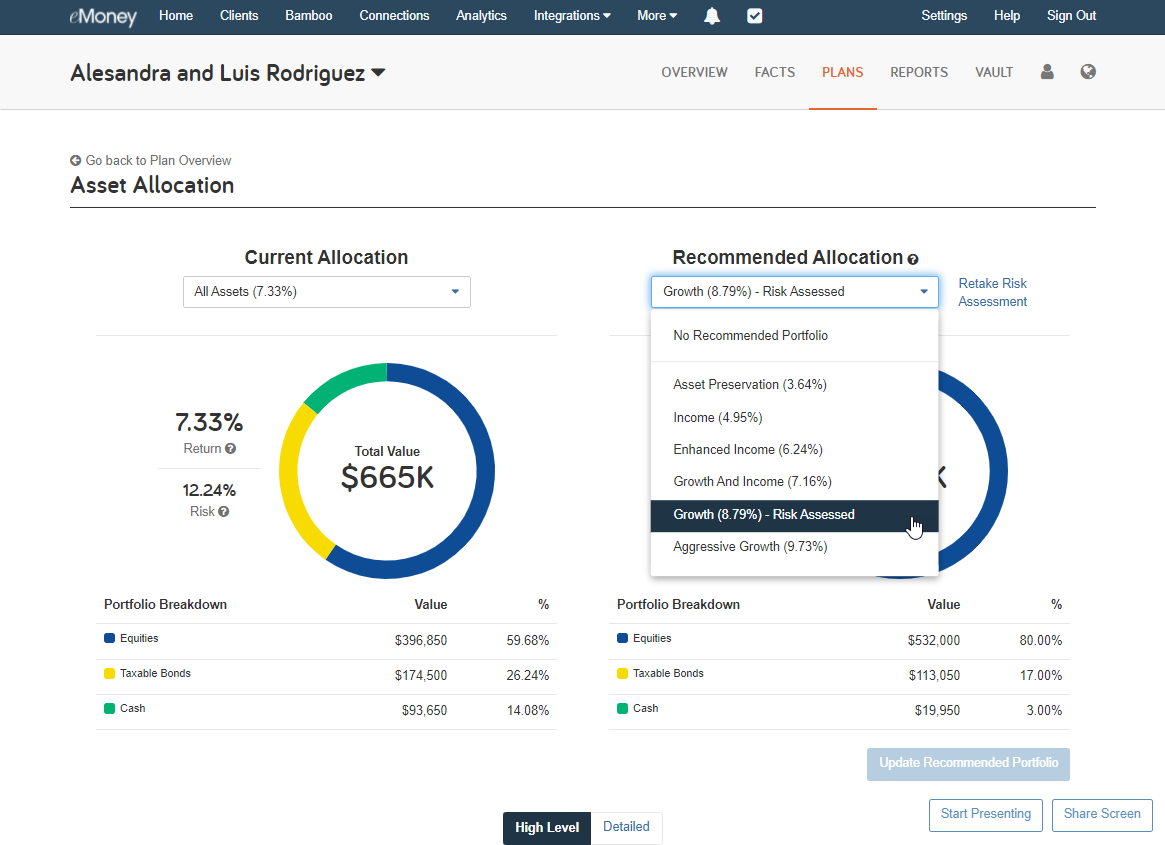

Let’s click into the Asset Allocation tool under Additional Topics. From here, you can easily open the risk tolerance questionnaire by clicking Take Risk Assessment on the top—right next to Recommended Allocation.

This action will pull up a short 12-question risk tolerance questionnaire that, once complete, shows the “risk-assessed” recommended portfolio under Recommended Allocation.

Pro-tip: Return is calculated as the weighted average of the gross growth rates of investments selected to be reallocated as of today. In comparison, Risk is calculated as “standard deviation,” a measure of the portfolio’s volatility of returns around its average annual return.

Now that we’ve determined their risk-assessed portfolio recommendations, we can go back and see how reallocating assets within their Proposed Plan will impact their probability of success.

From the Plan Overview, click Go to Plans, click into the Selected Topic drop-down menu, and open Asset Allocation.

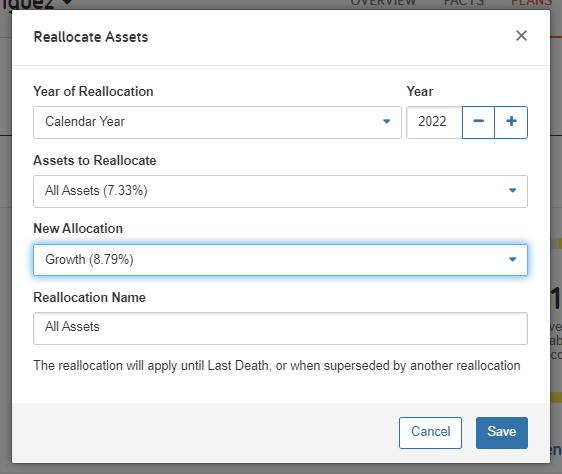

You should immediately see the +Reallocate Assets button under the Recommended Plans column. Click this button to open the reallocation module and select the appropriate New Allocation based on their risk assessment. You can opt to reallocate All Assets by selecting by group (e.g., Non-Qualified, Retirement, Taxable), or select a specific asset.

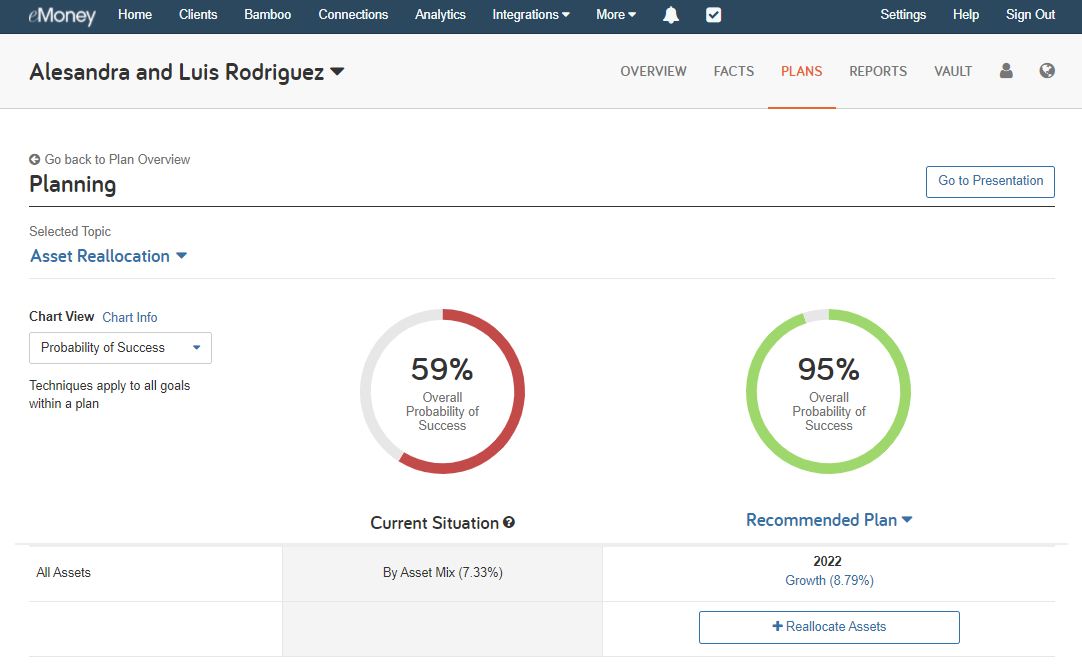

For simplicity, we’re selecting All Assets to reallocate for the Rodriquez’s. Upon recalculating their probability of success, their Recommended Plan has gone back up to 95%!

As you can see, Foundational Planning’s asset reallocation tools provide a simple way to demonstrate to clients and prospects how reinvesting their assets can provide a long-term boost to the probability of achieving their goals.

When the time comes to meet with your client for information review and goal planning, the presentations and deliverables we offer can provide a step-by-step walkthrough of all the key data for your meeting with the client. You can present in person, through a virtual meeting, or by using printed materials you can email or upload to the client vault for their review. Let’s review how to start this process.

From the client overview page, click Plans. If there aren’t any current goals entered, the first thing you will do is enter a goal. An excellent place to start is with a retirement goal. For Frank and Joanna Miller, what they currently have entered in the Facts shows they will fall short for retirement. We created a new goal to show the changes they need to make to succeed.

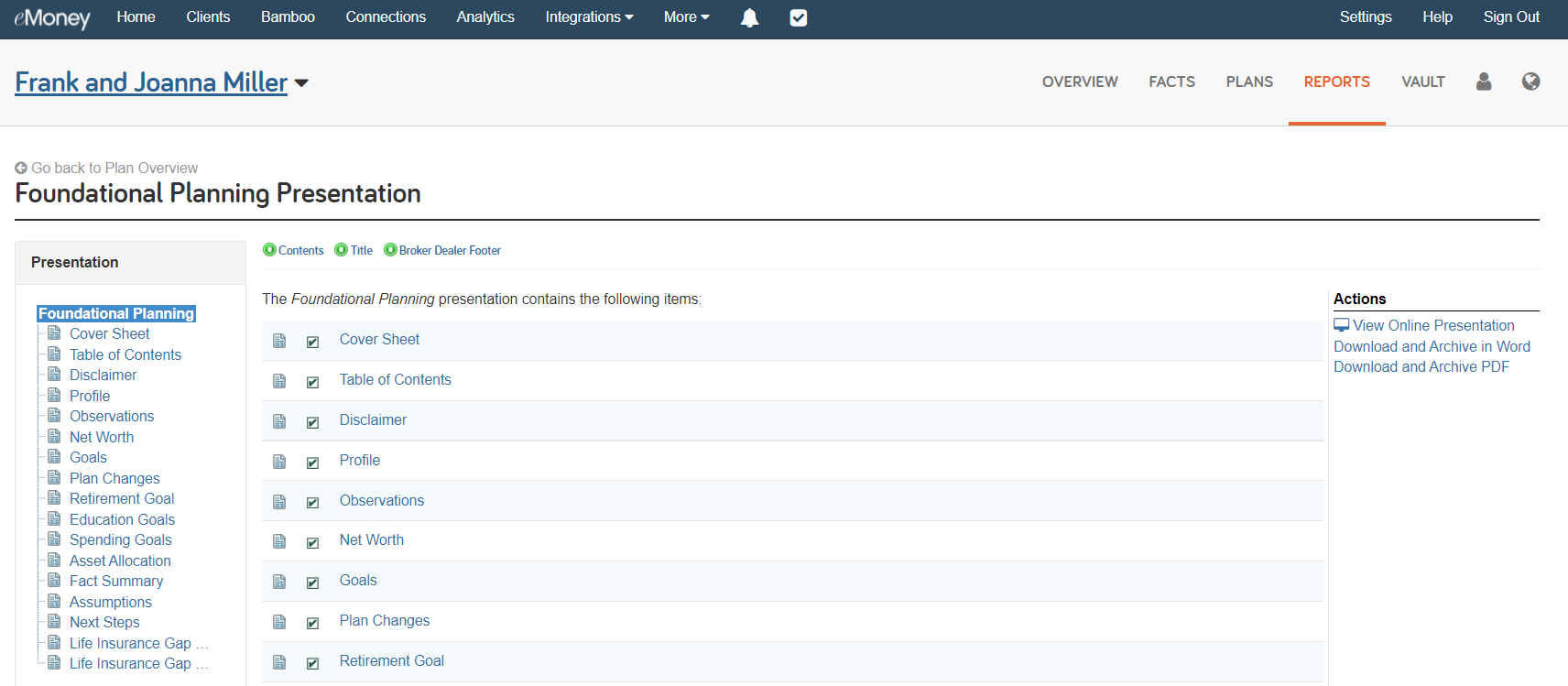

Once the goals have been entered and you are ready to start building a presentation, click Go to Presentation in the top right.

Here you can start customizing your presentation. By default, Foundational Planning will select all the options. You can deselect anything you do not want to show the client by clicking the checkbox next to each item. For this example, we will deselect the education and spending goals to focus on retirement.

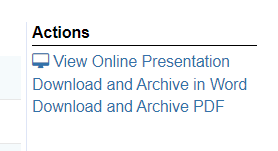

Once all the items you wish to show the client are selected, you can choose to View Online Presentation, Download and Archive in Word, or Download and Archive in PDF. View Online Presentation is an excellent option if you meet with the client in person or virtually. The Download and Archive options allow you to send these documents to the client via email or upload them to the Vault. These options are available to the right of the screen, under Actions.

If you ever need assistance building a plan, a presentation, or both, you can always reach out to our Customer Support team by phone at 888-362-8482, Monday through Friday, 8:00 a.m. to 8:00 p.m. ET.