for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreTaxes are one of the most complicated aspects of eMoney’s planning simulation. Each year we update our tax assumptions to account for any new tax laws and adjustments to existing laws.

If your tax projections don’t seem right, we’re here to help you track down what’s throwing them off. Introducing your new best friend and our number one eMoney tax simulation diagnostic tool—the Tax Events Ledger.

To access the Tax Events Ledger, go to Reports – Ledger then select the Tax Events sub-report.

Now that you know where to go, let’s break down the report itself, then talk about how you can use this report to ensure the accuracy of your clients’ tax projections.

Note: This post assumes you’re using the Form 1040 setting for your Tax Assumptions.

The Tax Event Ledger provides a detailed breakdown of your clients’ taxable events that occur in a given year. It’s important to note that the Amount being displayed is not your tax liability on a given account, but the amount of income that is subject to tax. Head on over to the Income Tax Report to see the calculated tax liability.

There’s also a high-level Description of the event and details on the Type of taxable event.

Finally, you have visibility into the Account and type of Transaction triggering the taxable event.

This means you’ll have all the information you need to see how a client’s taxes are generated in a given year, and where to go to resolve any issues.

Is an expense showing as deductible when it shouldn’t be? You can fix that.

Are you generating short-term capital gains or investment income that shouldn’t be realized? You can fix that too.

The Tax Event Ledger gives you the insight you need to properly diagnose and take action on any tax-related issues within the eMoney simulation. Then head over to the Facts area to take action on those issues.

This report also gives you insight into taxable events for other entities such as businesses, trusts, or other important entities entered into the system.

Even if there’s nothing wrong on the Tax Event Ledger, you still may not be capturing all the possible tax events accurately.

Start by making sure you’re keeping track of deductible expenses. The Living Expense Worksheet can be used to accurately track your clients’ property taxes, charitable gifts, and other miscellaneous expenses that require tracking for tax purposes.

You can also utilize Other Expenses to capture events that don’t line up with the timing of living expenses. There are many tax-deductible types to choose from when adding an Other Expense to fit your specific need for any tax situation.

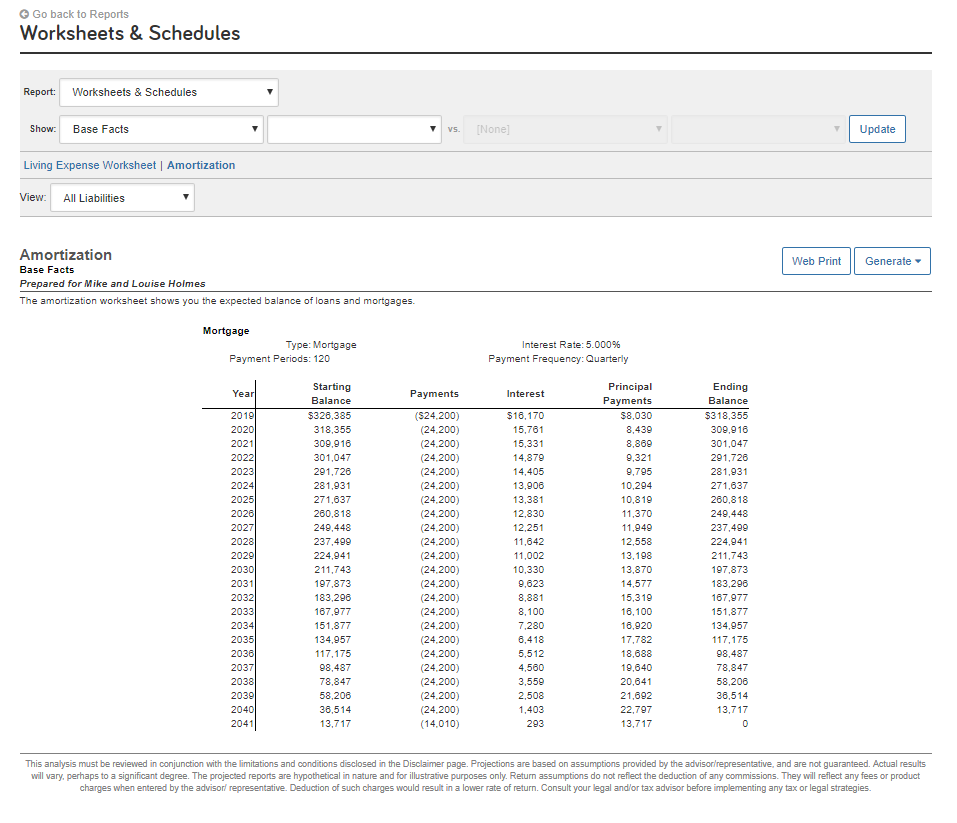

The Amortization sub-report under Worksheets & Schedules provides insight into your clients’ mortgages and allows you to ensure their payments are scheduled properly.

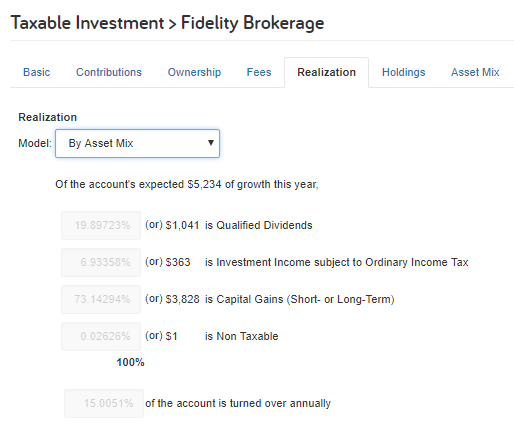

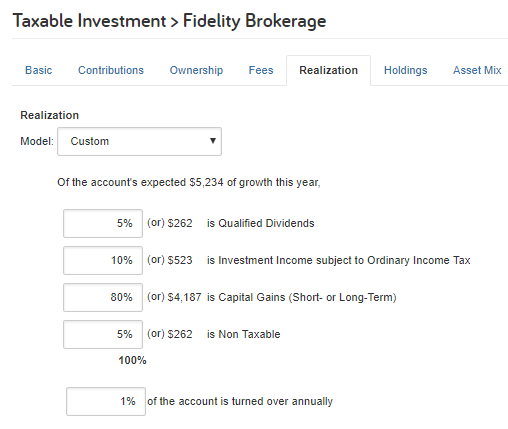

Another aspect of the tax simulation to monitor is the Realization on your client’s accounts. The Realization controls the tax characteristics of taxable accounts.

For connected accounts that have holdings, you can use By Asset Mix which allows the system to define the growth by the underlying characteristics of the actual holdings in the account.

Remember, the realization tab is just an estimate of the taxable growth for non-qualified investments. This may not directly reflect information from actual holdings and may need to be edited. This is important to review when putting together the plan.

If it’s a manually entered account, consider using a Model Portfolio or Custom realization to define the growth. Model Portfolios will assign the realization based on the asset mix defined in your Investment Assumptions, and Custom lets you define the model.

Pro Tip: To calculate your short-term capital gains, simply multiply the annual growth from capital gains by the percent of the account that is turned over annually (turnover rate). For long-term capital gains, take the total unrealized gain (current value less tax/cost basis) and then multiply by the percent of the account turned over each year (turnover rate)..

Check out a recap of our Advanced Series – Income Tax webinar in the blog post below.

Or log in to eMoney and search “Taxes” under Help in the Knowledge Base for FAQs, videos, and user guides.