for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreEducation planning is critical in giving your clients’ children the chance to pursue their dreams and aspirations without financial constraints. Education planning is a multifaceted process that encompasses more than just setting aside funds for tuition fees. It involves meticulous research, strategic thinking, and informed decision-making.

Below are the key components you’ll want to account for when supporting your client through the education planning process.

Putting into Practice:

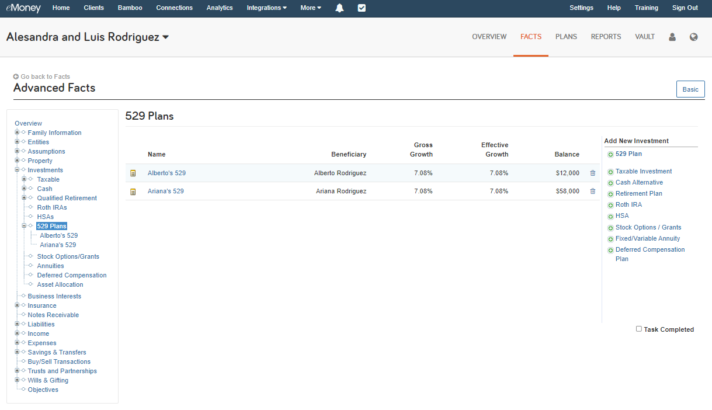

How to Add a 529 Plan in the Facts

Enter the 529 Plans your clients have for each of their children within Advanced Facts by choosing 529 Plans under Investments.

Once all 529 Plans have been entered properly, you can start to take advantage of the education reports.

Reports Dedicated to Education Planning

Within the Education Planning report family, there are a number of sub-reports that assist with planning dedicated to education.

Solutions for Funding Shortfalls

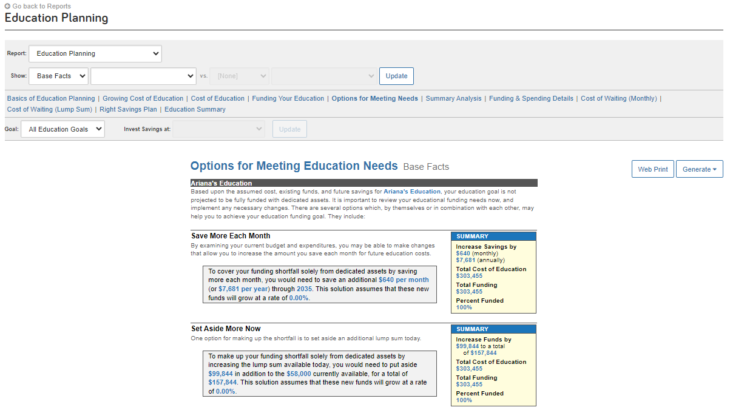

Now that you’ve had the opportunity to review costs and funding, it’s the perfect time to explore potential solutions to any funding shortfalls using the Options for Meeting Needs report. While still in the sub-report Education Planning category, this report deserves a special call out.

The Options for Meeting Needs report looks at the funding shortfall of the client’s education goal and provides solutions to close the funding gap. This report details how much more they need to save each month, put aside in bulk now, or, if necessary, what kind of reduction in costs would be required to meet their goal.

Additional Resources: