for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreProtection planning is an important concern for many clients – if something happens to me will my spouse be taken care of? Will we still have assets to pass on to our loved ones? Answering these questions can provide your client peace of mind that their affairs are in order no matter what happens. Luckily eMoney has the tools needed to address these very issues!

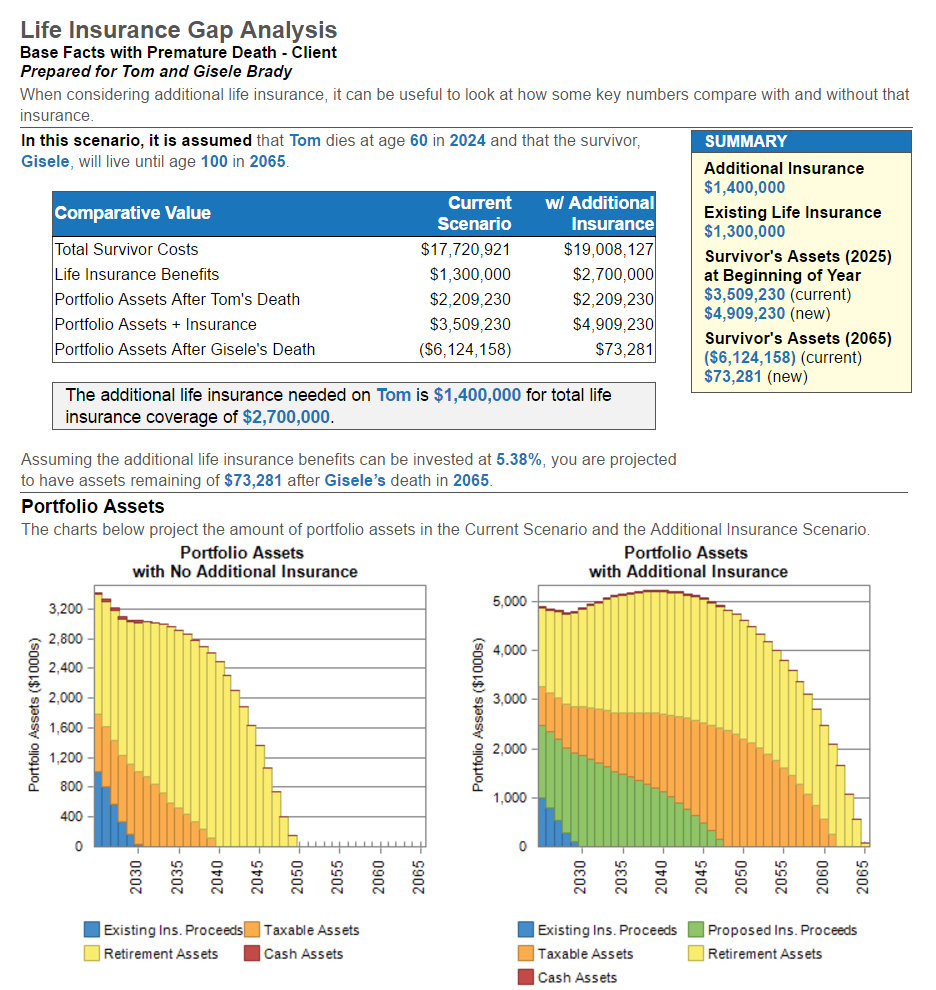

The Life Insurance Gap Analysis Report

The Life Insurance Gap Analysis report is a powerful tool that allows you to create and present a proposal to a client that will determine the amount of insurance required to make sure their spouse is provided for in the event of the client’s untimely passing.

The report depicted above provides us with some key information that we can pass along to the client. By clearly stating the assumptions used within the system’s calculation, we can confidently state that Tom would require an additional $1,400,000 of coverage to provide for Gisele in the event of his passing.

Adjusting the Variables

By walking through the report with the client while focusing on the areas highlighted in the blue text, we can demonstrate to the clients the assumptions we are using in our calculation – but how do we adjust those variables?

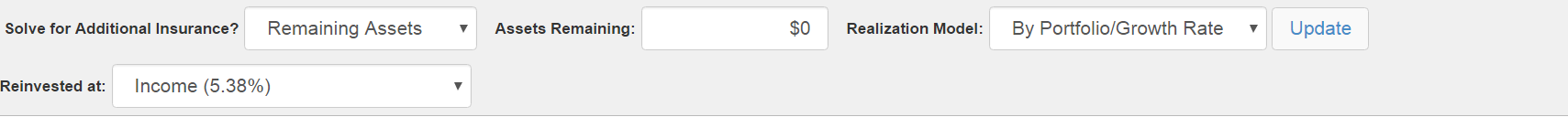

At the top of our report is an area called the report parameter bar. This houses a couple of the key variables the system takes into consideration when generating its output:

Solve for Additional Insurance? – We have two distinct options to choose from here: “Remaining Assets” or “Asset Replacement”. By choosing the former, we can tell the system within the Assets Remaining box what the minimum amount of assets we want to be remaining when the spouse passes. Choosing the latter will simply solve for the assets they would have in the event that both client & spouse live to their assumed age of passing.

Realization Model: This allows us to dictate the taxation of the account in which insurance proceeds would be deposited.

Reinvested at: This allows us to tell the system what growth rate we want to apply to proceeds from the policy.

What about the age of death?

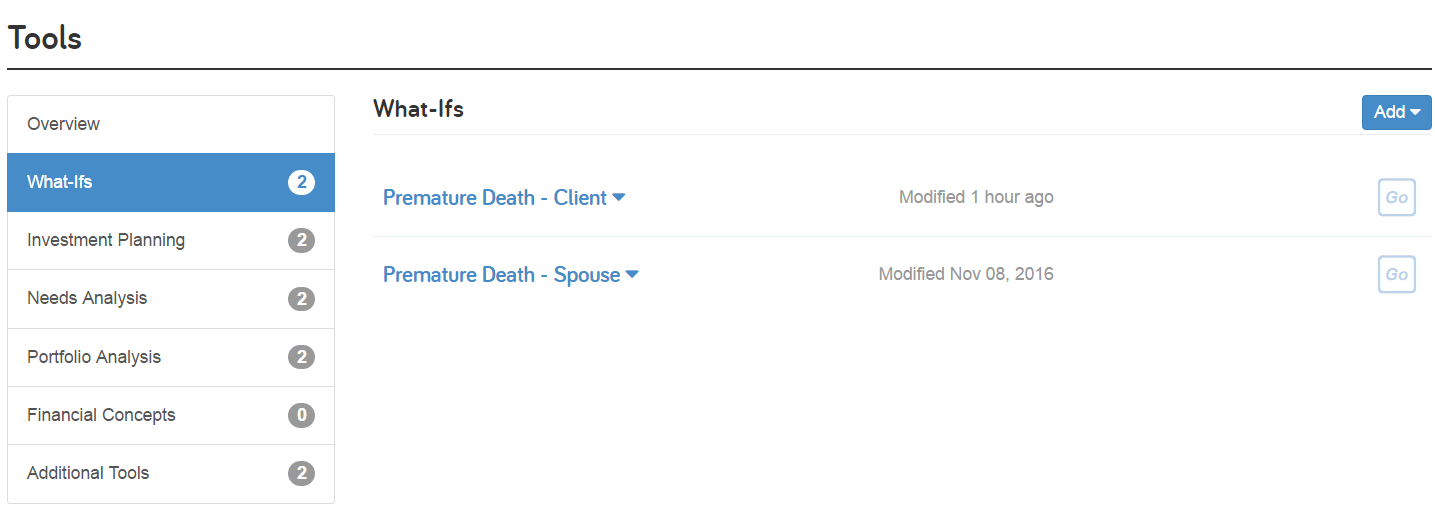

The assumed age of death can be influenced using a mechanic within the system called a What-if. These allow us to apply a number of stress tests to a client’s plan, in this case illustrating a premature death.

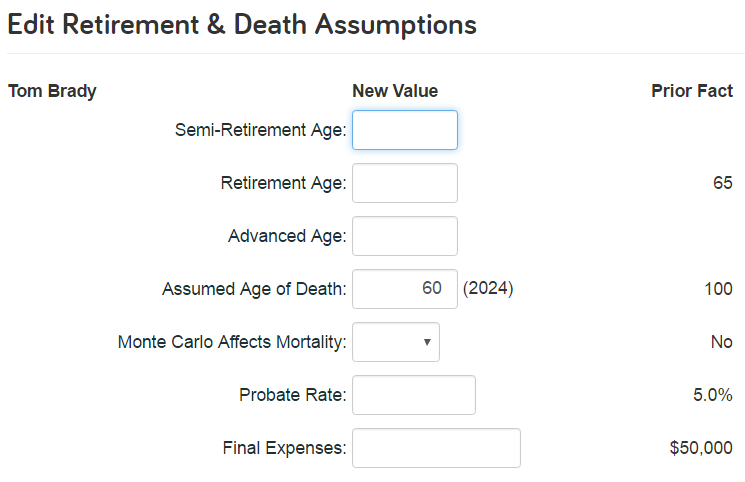

Located in the Plans tab in the Tools section, we find a template What-if entitled “Premature Death – Client”. By clicking the Go button to the right-hand side we can make an adjustment to the assumed age of death we want to use in our Gap Analysis report by clicking on the blue change entitled Retirement/Death Assumptions.

Decision Center

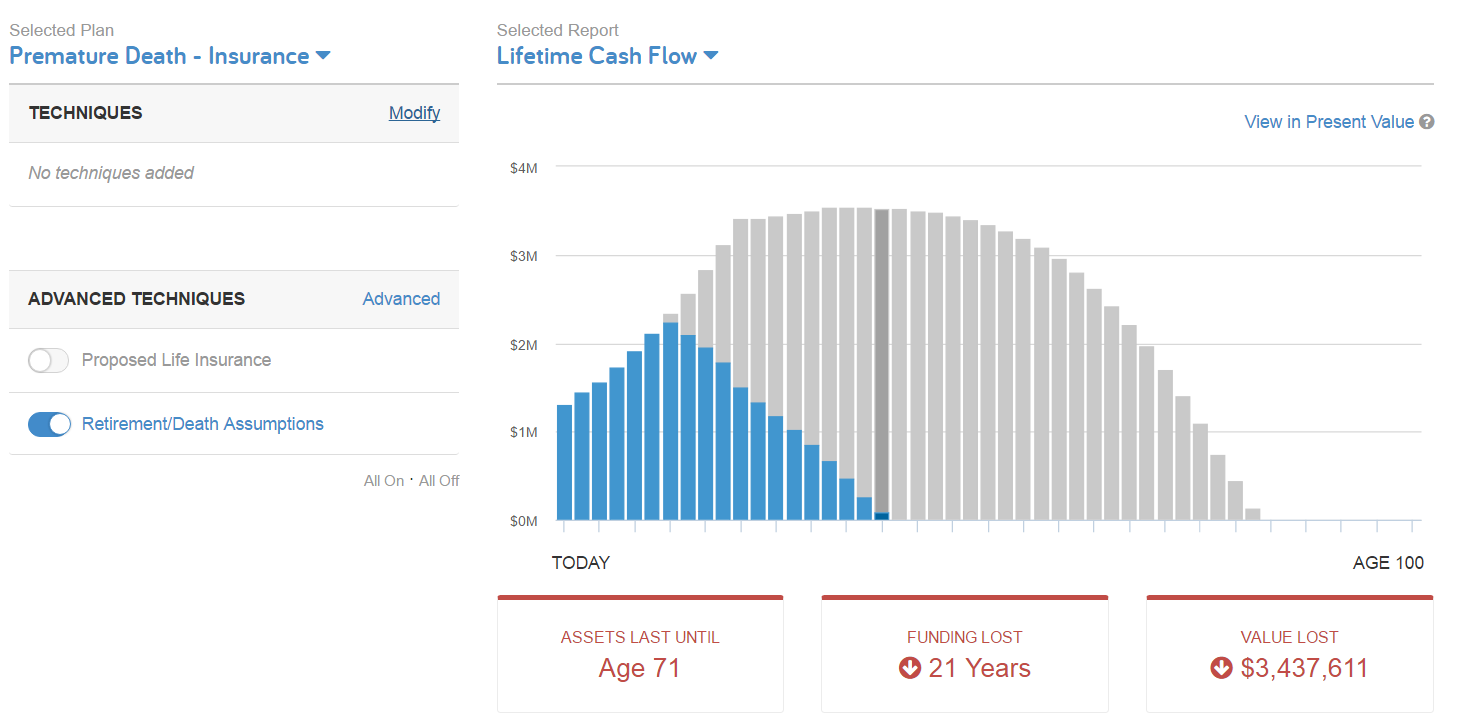

So now that we’ve put together a gap analysis for our client and determined how much insurance that they are going to need, how can we go about presenting this information most effectively in a meeting? By using the Decision Center we can show a client the difference in remaining assets between a scenario in which they have insurance versus not.

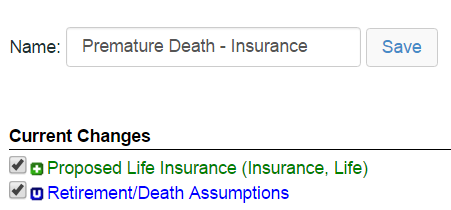

By creating a scenario using the Advanced Planning tool, we can make modifications to the client’s assumed age of death, as well as illustrate a proposed life insurance policy. When we open this scenario within the Decision Center, we can then toggle that policy on or off to show the impact that additional protection would have for our clients.

Without Insurance