for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreIn preparation for the migration to your new eMoney Cetera office this June, here is a preview of some new features and functionalities you will soon have access to. We recommend saving this post as a reference once you are officially migrated into your new eMoney Cetera office so you can explore first-hand.

We broke out these features into the following categories:

Life Insurance Gap Analysis Module

With the Life Insurance Gap Analysis in Foundational Planning, you can easily demonstrate if your clients’ current life insurance and other resources provide adequate protection for their families. Check out this 90-second video to preview how to use Foundational Planning’s Life Insurance Gap Analysis module to help your clients analyze their life insurance gap.

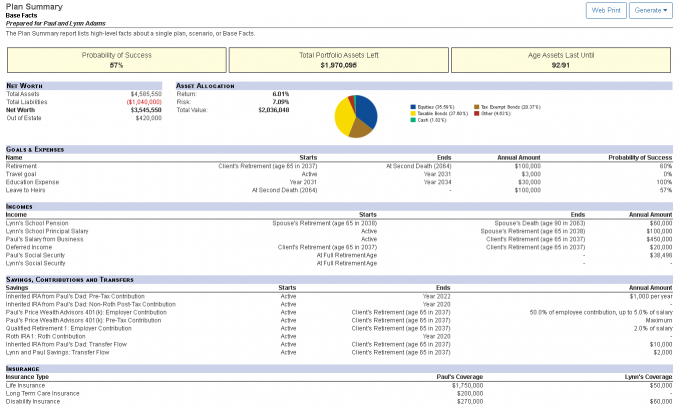

Plan Summary Report

Once migrated over to Cetera, you’ll have access to the full suite of eMoney reports including the new Plan Summary Report.

This report—for both Advanced Planning and Foundational Planning users—provides a concise summary of key details regarding a client’s financial plan. The Plan Summary Report provides your clients with a breakdown of the essential information regarding their plan, including:

Other new reports include Monte Carlo, Cash Flow, Interactive Estate Planning, new Distribution Center reports, and more!

Monte Carlo Longevity Risk Analysis and Confidence Age

Life expectancy is hard to predict. Our Monte Carlo features make it easier than ever to provide a comprehensive and personalized analysis of longevity risk so you can have more engaging conversations with clients.

Watch the video below to learn more about our Longevity Risk Analysis and latest planning metric—Confidence Age.

Health Savings Accounts Available as an Account Type

Once in your new office environment, HSAs will be available throughout the entire eMoney system, which means you’ll notice their addition in a lot of familiar places such as:

Building out an HSA Fact is done much the same way as most other Facts, but with HSA-specific fields.

New Word Doc Presentations/Reports Format Option

Presentations created in Microsoft Word will now be saved by default as .docx files rather than .pdf files for easier editing.

Once migrated, you’ll have access to new integrations such as Addepar, Dropbox, iRetire by BlackRock, Riskalyze, and more!

Lead Capture is a workflow designed to entice a prospective client to sign up with a financial professional of the firm by letting them illustrate a goal, identify a need, and streamline a path for getting help. The workflow ends with a request for a consultation with the financial professional, and once completed, the client will be added to the eMoney client list. From there, a Client Site can be established be sending the client through Self-Registration.

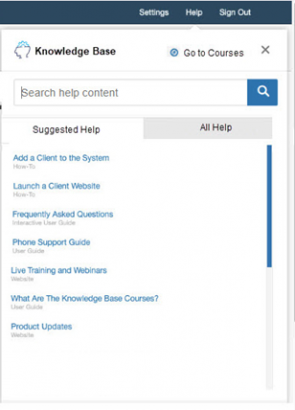

Enhancements are coming to your Knowledge Base resources and Help menu to more intelligently meet users where they are in eMoney.

A new two-tab interface will include both Suggested Help and All Help sections. The Suggested Help tab showcases context-sensitive resources specific to the page the user is on, to better support you with the right resources when you may need them most. The All Help tab is closer to how your Help menu currently looks but will maintain many more categories of resources.

Once migrated, you’ll have the ability to edit your contact information and a client’s Net Worth History to ensure the accuracy of their data. There are a few reasons historical net worth numbers can be incorrect, including:

Note: This page will only be accessible to users with Producer licenses for eMoney. Support users do not have the ability to update Net Worth History.

These are some features you can look forward to experiencing once you’re migrated to your new eMoney Cetera office. Keep an eye out for additional eMoney and home office communications with more information regarding migration readiness to ensure a smooth experience for both you and your clients!