for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreAs a centralized hub for all the technology platforms you use every day, we’re always exploring opportunities to increase the depth of each integration. That way, you finish more work in less time and can focus your efforts on clients.

With single sign-on access and the ability to import clients and risk questionnaires, Riskalyze has long been one of eMoney’s most popular integrations. Which is why we’re excited to announce new enhancements, releasing this month, that will allow for a more seamless and simple experience.

Currently, Riskalyze users can import clients from Riskalyze. They can also sync clients’ risk numbers and risk questionnaires directly onto their eMoney Client Overview page. But, importing other client data from eMoney into Riskalyze requires a 10-step process.

The upcoming enhancements to our Riskalyze integration will allow you to easily export client accounts from eMoney to produce their current Risk Number.

It’s easy!

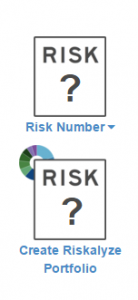

Simply choose to create a Riskalyze Portfolio on your eMoney Client Overview page.

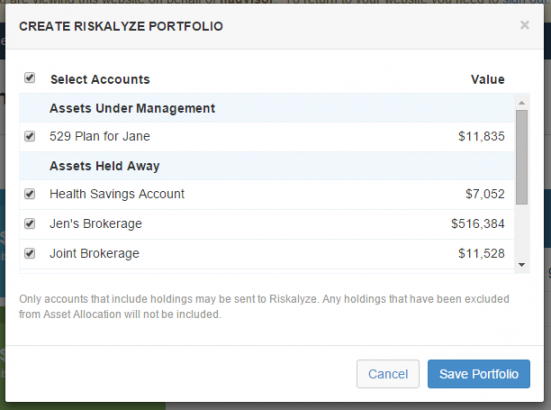

You will then be prompted to select the accounts you would like to export to Riskalyze.

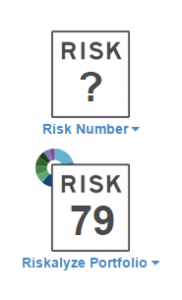

Now, click Save Portfolio and the Risk Portfolio is displayed on the Client Overview page.

That’s it!

Insights into your clients’ Risk Tolerance versus their current Risk Number help you to understand when is the perfect time to start a conversation around your client’s current portfolio and cuts what was once a 10-step process into three simple steps.

For more information about the enhancements to this integration sign up for our hour long Riskalyze webinar on June 22nd at 4 pm ET.