for expert insights on the most pressing topics financial professionals are facing today.

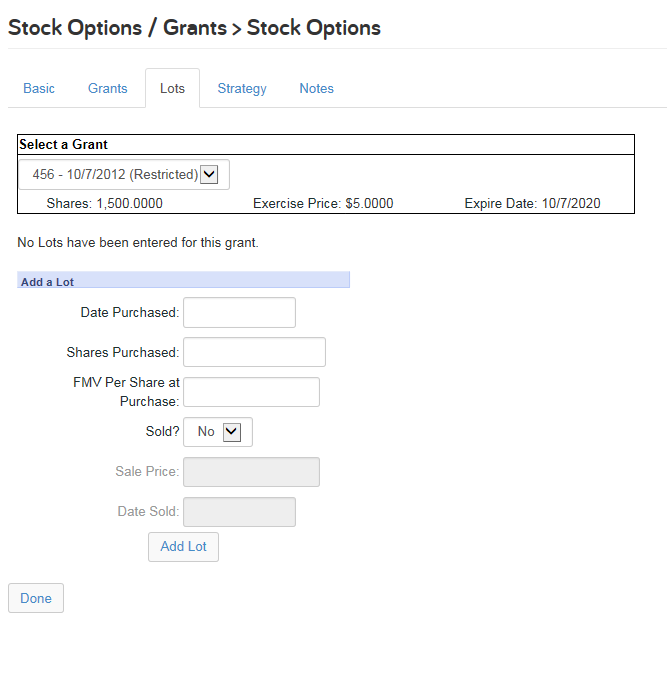

Learn MoreStock options are common to many clients’ portfolios and often represent a great investment for limited risk. Within the Advanced Facts area of the eMoney system, advisors have the capability to model all types of stock options, including Restricted, Non-Qualified, and Incentive Stock Options by using the Grants, Lots, and Strategy tab.

Important to many Options is the Lots tab, which is used to show shares that have already been exercised. Typically, Lots are used when:

Lots also allow you to get the tax treatment for shares you have had in the past.

When the Lot is entered and sold in the system for Non- Qualified, ISOs and Restricted Stocks the difference between the Lot’s Sales Price and the Lot’s FMV per Share at Purchase is considered Capital Gains when the Date Sold of the Lot is a year or longer from the Date Purchased.

However, when the Date Sold is less than a year from Date Purchased for the Lot, the difference between the Lot’s Sale Price and the Lot’s FMV per Share at Purchase is considered Short- Term Capital Gains and is captured in the Investment Income from Options/ Grants column on the Tax Impact report.