for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe Buy/Sell transaction is used to show a future purchase, sale or both. It is an integral part of many plans because of its versatility and ability to accurately model the outflows and inflows associated with a future transaction.

In many cases, simply adding or removing an asset in a plan is not enough to represent the reality of the transaction. Without a Buy/Sell, the asset would basically appear from thin air or vanish entirely which neglects the inflow/outflow incurred by the client. So whether your client is downsizing to a smaller home, selling their business, or simply looking to plan for a large future purchase the Buy/Sell transaction is the right tool for the job.

Setting Up a Transaction:

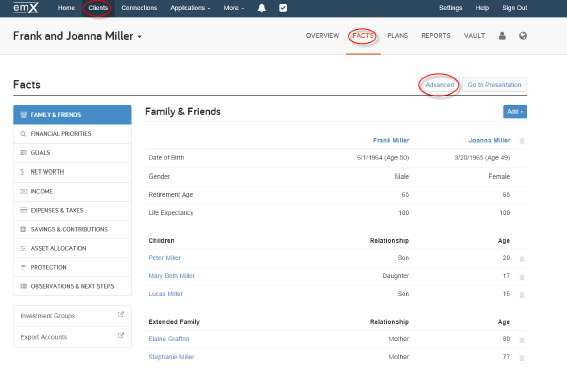

To set up a future transaction using a Buy/Sell, you must first select Facts, then Advanced.

Start by navigating to the Advanced Facts.

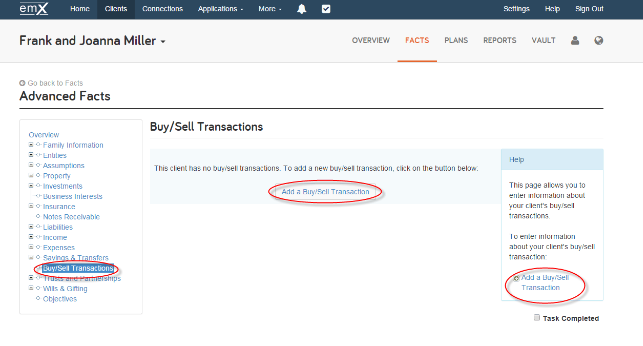

After selecting Buy/Sell on the left-hand tabs, you will click Add a Buy/Sell Transaction.

Add a Buy/Sell Transaction.

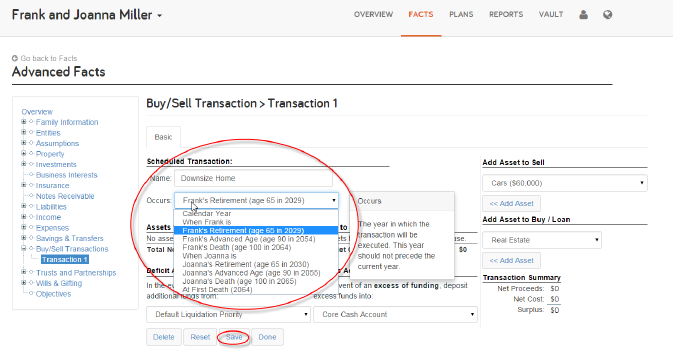

In this example, you will downsize the Miller’s current home by selling the old residence and then purchasing a new less expensive home. After naming the transaction, you will indicate when it occurs and press Save.

Define when the Buy/Sell occurs.

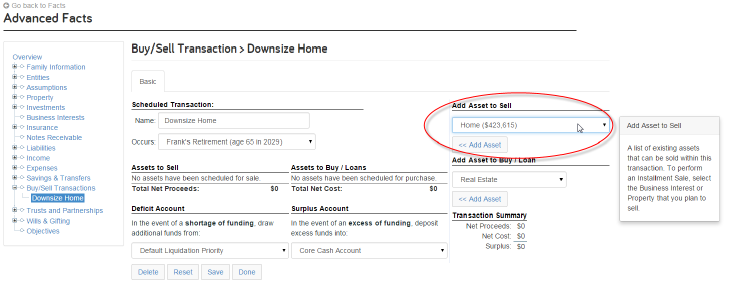

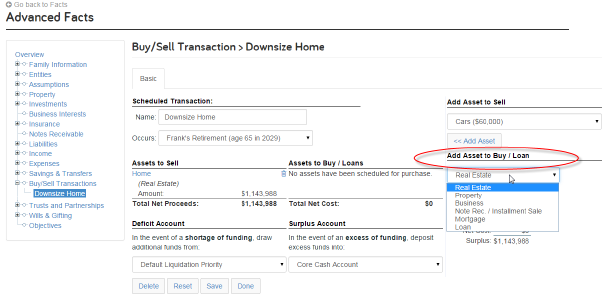

You must then define what is being bought and what is being sold. To show the sale of the current home, click the Add Asset to Sell dropdown, select the current residence, then press Add Asset.

Select the asset to sell.

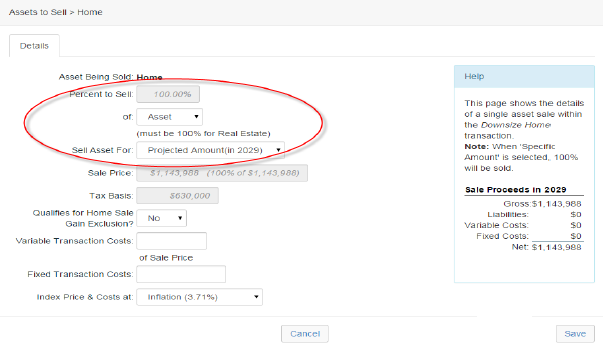

On the next window, there are various inputs available such as Percent to Sell, Sale Price, Fixed Costs and Variable Costs. If an asset is partially sold with the Percent to Sell field, it will still be available for future buy/sell transactions.

Define whether you’ll sell the asset for a specific amount of a projected value.

Next, you can select the asset to purchase, in this case, a new less expensive home. Adding an Asset to Buy/Loan will add a new fact for what is selected.

Select the asset to buy.

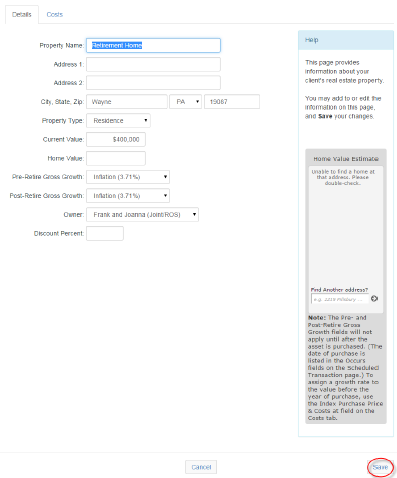

You will then input the asset’s information on the next screen and click save.

Define the characteristics of the new property.

Utilizing Deficit & Surplus Accounts:

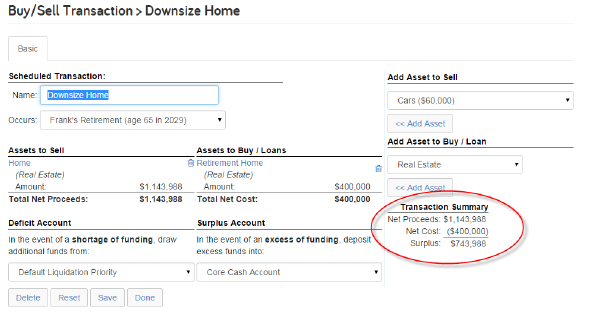

Finally, after defining the assets to be bought and/or sold, the system will calculate a transaction summary. If a deficit exists, you will need to choose a deficit account to draw from. If there is a surplus, you can also choose where the excess will be deposited.

View a summary of the transaction and any surplus or deficit.

Buy/Sell Using Different Assets:

Buy/Sell transactions are extremely versatile and can be used to model a wide variety of situations with many different types of assets. For example, to refinance a mortgage in a plan a buy/sell is used to show the acquisition of the new mortgage. Overall, Buy/Sell’s are a flexible tool that can enhance a huge number of plans.

Interested in more tips from the eMoney Training Team check out our Live Training events and Webinars. Have a question? Give us a call at 888-362-8482 or send us an email.