for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreIn today’s digital age, financial advisors and their clients rely on account aggregation tools to simplify the process of managing multiple financial accounts in one place. We understand the importance of having an aggregation experience you and your clients can trust, and are pleased to share that eMoney is the industry leader in account aggregation tools*

In recent years, significant improvements to eMoney data aggregation service have resulted in:

We continue to prioritize streamlining the advisor and client experience and provide you and your clients with an efficient and effective data aggregation experience.

Continue reading to learn about:

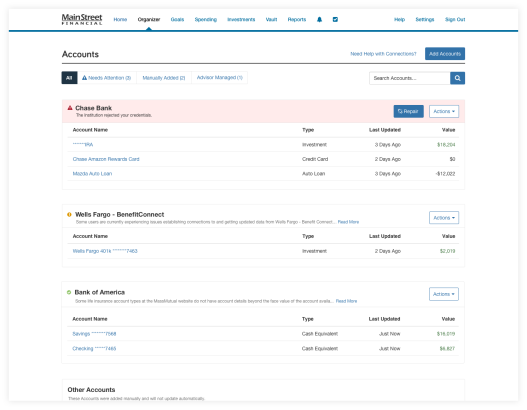

We are unwavering in our dedication to enhancing connection stability so you can provide a complete financial picture for your client. With many financial accounts spread across different institutions, it can be challenging to manage them all and make informed decisions.

Bringing all of these accounts into one place allows for a more comprehensive view of your clients’ financial situation, and helps you to:

Overall, account aggregation is a crucial tool for financial advisors and their clients to manage finances effectively, make informed decisions, and achieve long-term financial stability.

As the industry leader in account aggregation tools, we have always been committed to providing our users with the best experience possible. We are continually innovating and improving our platform to make managing financial accounts easier and more efficient. Learn more about some of the product updates we’ve made recently to deliver on this commitment.

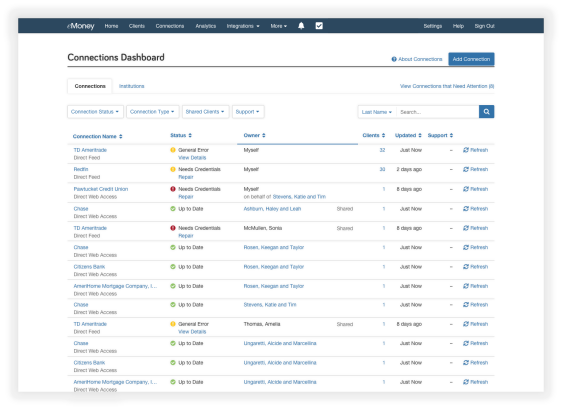

APIs create a seamless flow of data by enabling two systems to interact and connect securely without the need for login credentials. As of Q1 2023, 83% of eMoney connections are aggregated via API’s. This “view only” access to account data ensures data collection and copying, while preventing any unauthorized transactions. We have achieved substantial progress in migrating the most-used major institutions to API-based connections since 2020, including:

In our ongoing efforts to support you, API progress constantly is moving forward with highly used institutions such as TD Ameritrade accounts which will be converted to Schwab API in September of 2023.

While many connections have transitioned to APls, some work better as Parsers**. Because of this, we are also dedicated to enhancing the usability of our Parsers to ensure seamless data aggregation. Since 2020, we have expanded to over 1,300 connections, including highly requested institutions such as iBanking, Truist, and Eastern Bank.

Additional resources on connections and APIs can be found in the Help menu on your advisor dashboard. Below are a few of our favorites:

You can also bookmark the Product Update page, where we will provide quarterly updates on connection enhancements.

*2023 T3/Inside Information Advisor Software Survey Results

**Parser connections are a form of screen scraping. Screen scraping is a process in which software extracts data from the user interface (UI) of a website or application, typically by simulating user interactions to mimic the scraping of information displayed on the screen.