for expert insights on the most pressing topics financial professionals are facing today.

Learn MoreThe eMoney Decision Center is a powerful planning tool that gives your clients an in-depth and personalized look at their financial picture using advanced planning techniques and what-ifs. With Decision Center, you can work side-by-side with your clients to demonstrate the financial impact their decisions have on their plans and adjust them in real-time for immediate feedback and insight.

In this post, we’ll walk through the essential information you’ll need to know when presenting the Decision Center to prospects.

We constructed all sample clients with a narrative designed to help you explain their situation and demonstrate the power of eMoney planning functionality to your clients. We highly recommend further customizing these sample clients so their names, techniques, and base case reflect your clients’ demographics and unique needs.

Or create a brand new sample client of your own to perfectly align with your target market!

Jermone is a business owner who is starting to wonder about exit strategies for his business. Use this sample client to investigate different ages and prices for the sale of a company, including a note receivable. Show prospects how their exit strategy can significantly impact retirement goals.

Pre-built techniques include:

Marco is approaching retirement. He was a high earner during his employment, but a significant portion of the couple’s wealth is in an options plan provided by Marco’s employer.

While the Espositos look great on paper, you can use the Decision Center to show how vulnerable they are to a drop in share value. Would they need to downsize their home? Can they afford to help their grandchildren with college?

Pre-built techniques include:

The Xiao’s are wealthy business owners getting ready for retirement and looking for exit strategies that will allow them to leave a legacy and support their family. Their case is excellent for demonstrating the impact of unexpected financial events like the built-in what-if for providing financial support for an ailing parent. Add new what-ifs to show life’s unpredictability.

Pre-built techniques include:

Frank and Joanna are a great sample client to use for a retirement case. They’re relatively high-earners with children approaching college who have built wealth over time but have somewhat unrealistic expectations regarding lifestyle in retirement.

You can use the Millers to demonstrate how it will take careful planning to help them achieve their goals and how standard techniques like delaying social security and retirement or selling a vacation home can significantly impact their success.

Pre-built techniques include:

The Steins are retired and have a considerable net worth. They have plenty of money to fund their retirement and are interested in maximizing wealth transfer to the next generation.

Use the Steins to illustrate planning around their family and their legacy by highlighting gifting and trust strategies designed to transfer the most wealth possible without adversely affecting their retirement lifestyle goals.

Pre-built techniques include:

The Browns are high-earning young professionals who are not yet wealthy. They have yet to buy a house or start a family and look to the future.

Use the Browns to explore the impact to their plan of having children and purchasing a home. They’re also a great candidate for life insurance gap analysis by using premature death what-ifs to demonstrate their life insurance gap.

Pre-built techniques include:

The Rodriguezes are a young family with two small children. They are both high earners but are not on track for retirement, especially when factoring in paying for their children’s educations.

Designed with Foundational Planning in mind, the Rodriguezes let you demonstrate how small changes to their retirement ages and lifestyle expenses impact their overall probability of success. They are also excellent candidates for the Education Planning module included in Foundational Planning, as planning for their children’s education is a large part of their focus.

Once you’ve identified the sample client you’re interested in using to showcase the value and power of your financial planning technology, it’s time to head to Plans.

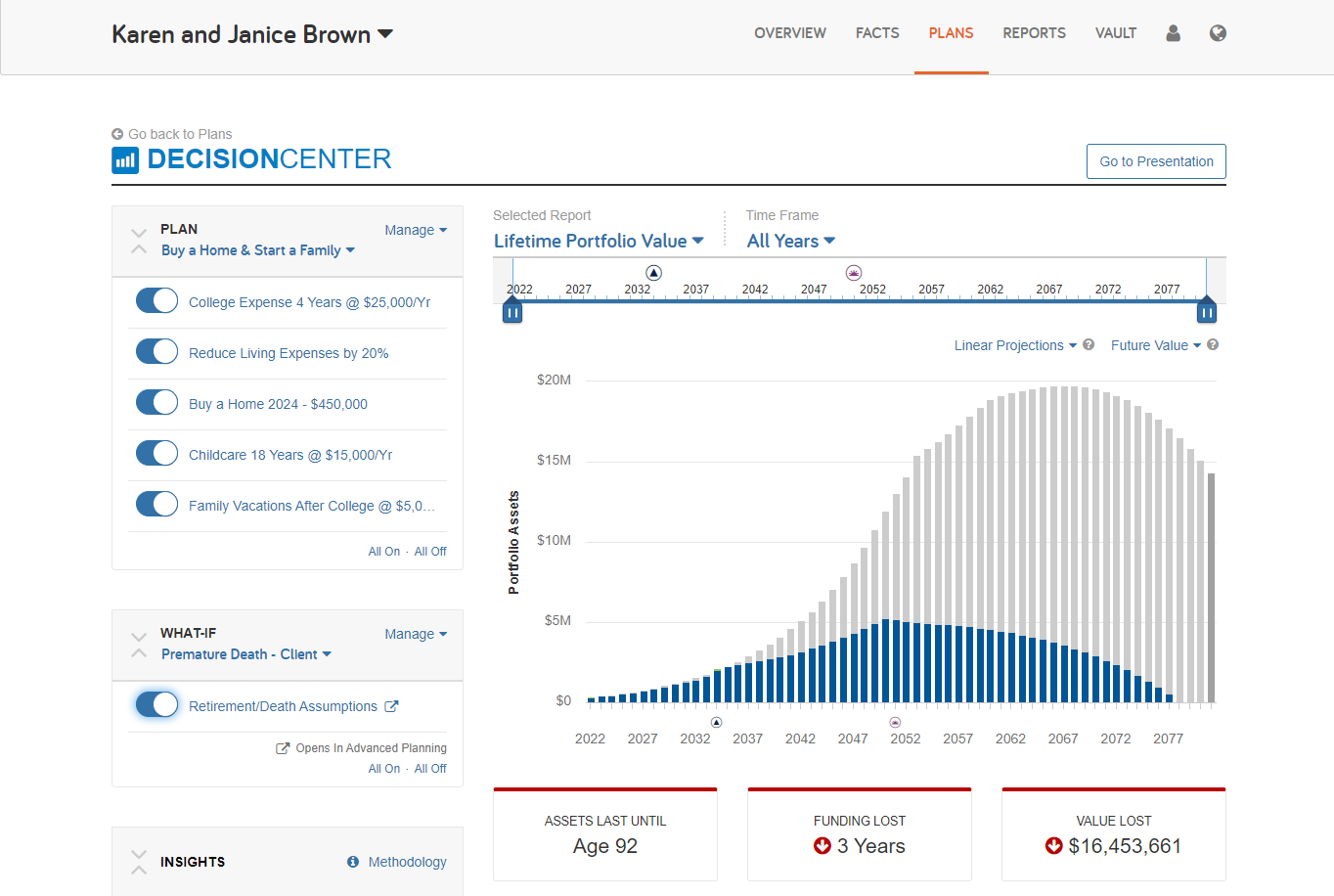

For this example, we’ve chosen our high-earning young professional clients, Karen and Janice Brown. The Browns have one default Plan called Buy a Home & Start a Family. Click the plan name and select Open with Advanced Planning to open the editor (you can also click the A.P. button).

Here you can see the pre-built plan includes four changes:

When all the default changes are selected, you can see below how it drastically impacts the success of their plan, causing them to lose multiple years of funding and lifetime portfolio value instantly.*

So what small changes can you recommend for this sample client to increase their probability of success?

With the addition of future childcare, education, and vacation goals, it’s reasonable to assume they’ll need to reduce their current living expenses. To accommodate their goals, let’s add a new change to this plan modifying the Living Expenses with a 20% reduction.

Click Manage and select Modify Techniques. Here you can choose Living Expenses under the blue column.

Pro-Tip: Green options add something new to the Plan, Red represents expenses, and Blue represents changes to existing Facts or Assumptions.

Once the change to Living Expenses is added, update the name and adjust the order of the changes to best represent how you’ll present the plan to your clients. Then click Done before clicking into the change and updating the expense values to represent a 20% reduction. Once complete, you can toggle the new technique to see how it impacts the plan! For the Browns, this adjustment to their current living expenses allows them to achieve their goals with minimal lost value.

Now you’ve had an opportunity to show a prospect how some simple goals like owning a home, having a child, and putting them through college can significantly impact a high-earner who isn’t careful with their spending.

By clicking over to the Monte Carlo report, you can even demonstrate how reducing their living expenses to accommodate their goals can significantly increase their probability of success.

But even once you’ve demonstrated how small changes can have a large impact on a person’s long-term goals, it’s essential to show them that a proper plan also accounts for the unexpected.

As young high earners just getting into their primary earning years who are interested in purchasing a home and starting a family, the Brown’s financial future is at high risk when stress tested by an unexpected death what-if.

For example, let’s test a Premature Death – Client what-if and see how their plan is impacted when Karen unexpectedly passes away at 45 years old. Click Manage next to What-If and select Pre-mature – Death Client. Then click into the what-if and update the assumed age of death from 95 to 45.

As you can see below, the loss of one of the primary earners has a significant impact on their Lifetime Portfolio Value and the success of their plan. Karen and Janice have a life insurance gap that needs to be addressed.

To quickly show how Karen and Janice can close the gap, select Manage next to Plan and select Go to Advanced Planning. Then under Planning Techniques, select the Add a New drop-down menu and click Insurance and Life to model a new life insurance policy.

Adjust the policy type, death benefits, and other fact details to match your recommendation. We’ll keep it simple and create a $1,000,000 term life policy for this example. While not recovering all the lost value, this coverage closes the gap and ensures total life funding while maintaining a 77% probability of success.

Additional changes, such as adjusting how the life insurance proceeds are invested, could provide even more impact.

The eMoney sample clients provide a great “base case” that you can use to build on to create a compelling story you can use when presenting a plan to your prospects. Sample clients allow you to leverage the interactive storytelling components of Decision Center immediately to show clients how small changes can have a considerable impact.

*Values shown may change based on updates to capital market assumptions and future changes to sample client facts.